Read more...

Stepping into the real estate industry can feel like venturing into uncharted territory. One of the most pressing questions new agents grapple with is, 'Where do I find my first leads and clients?'

|

Stepping into the real estate world? Whether you're a student eyeing the licensing exam, a rookie agent aiming for professionalism, or a seasoned pro sharpening your skills, mastering industry terminology Read more...

Stepping into the real estate world? Whether you're a student eyeing the licensing exam, a rookie agent aiming for professionalism, or a seasoned pro sharpening your skills, mastering industry terminology is key. But with a mountain of jargon to learn, it's easy to feel overwhelmed. Fortunately, powerful memory techniques can make even the most complex real estate terms stick.

In this guide, we’ll explore powerful and practical methods—like acronyms, mnemonics, visualization, association, and more—to help you lock real estate terminology into long-term memory. These memory tricks not only make studying more effective but also help you quickly recall important concepts when you need them most.

Pro Tip:

"Real estate terms? Overwhelming at first. My secret weapons: mnemonics and visuals. Learned them, owned them, and clients saw the difference."

— Nikil Balakrishnan - Licensed Realtor and ADHI alum

Ready to transform the way you learn real estate vocab? Let’s dive in.

Acronyms

What Are Acronyms?

An acronym is a word or phrase formed by taking the first letter of each word in a series. By turning multiple words into a single catchy “code,” acronyms simplify recall and help the terms stick in your mind.

Common Real Estate Acronyms

MLS – Multiple Listing Service

Meaning: A database used by real estate brokers to share information about properties for sale.

Context: Agents rely on the MLS to find properties for clients and to list their own sellers’ properties.

LTV – Loan-to-Value

Meaning: A ratio comparing the amount of a loan to the value of the property purchased.

Context: Lenders use the LTV ratio to gauge risk; a lower LTV is seen as safer for the lender.

PITI – Principal, Interest, Taxes, Insurance

Meaning: The four main components of a mortgage payment.

Context: Understanding PITI is crucial when calculating monthly home ownership costs.

ARM – Adjustable-Rate Mortgage

Meaning: A mortgage with an interest rate that can change periodically based on market conditions.

Context: ARMs often start with lower rates but can rise over time, affecting monthly payments.

HOA – Homeowners Association

Meaning: An organization in a subdivision or condominium complex that makes and enforces rules for the properties within its jurisdiction.

Context: Members pay HOA fees for communal services and maintenance.

Tips for Creating Memorable Acronyms

Keep It Simple: Use one to three syllables if possible.

Make It Personal: Incorporate your initials or a favorite word to spark a personal connection.

Use Humor: Funny acronyms are more likely to stick.

Be Consistent: If you create your own acronyms for study, keep them in a personal “Acronym Glossary” so you can reference them easily.

Mnemonics

What Are Mnemonics?

Mnemonics are memory aids that help you remember information through patterns like rhymes, acrostics, associations, or even songs. Below are a few mnemonic methods you can adapt for real estate terms.

Mnemonic Methods and Examples

Acrostics

An acrostic uses the first letter of each word to form a memorable phrase or sentence.

Example: “Lovely Houses Are Fun” to remember the four elements of a valid contract:

L- Lawful Object

H- Honest Consideration (often simply “Consideration”)

A- Agreement of the Parties

F- Form Prescribed by Law

Rhymes or Songs

Tunes and catchy rhymes make facts harder to forget.

Example: “When interest rates go up, bond prices go down.”

This helps you remember the inverse relationship between interest rates and bond prices, which is useful for understanding financial trends that affect real estate.

Storytelling or Association

Weave terms into a mini-story or scenario.

Example: If you need to remember the steps in a mortgage application process (pre-approval, property hunting, official application, underwriting, closing), imagine a character named “Preston” searching for a dream home, who then “applies” for a mortgage, is “underwritten” by a wise banker, and finally “closes” on his new property in a celebratory scene.

Short, Catchy Phrases

Condensing complicated terms into concise phrases can trigger your memory.

Example: “Check the Comps” as a quick reminder that you should always review comparable sales before listing a property or making an offer.

Alliteration

Use repeated consonant sounds for emphasis.

Example: “Frankly, Fair Market Value Finds Financial Feasibility.”

Other Memory Aids

3.1 Visualization

Method: Create a vivid mental image that connects with the meaning of the term.

Example: For the term “lien,” visualize a giant chain wrapped around a house, symbolizing that the property is “tied up” by a claim.

Visual Ideas:

Easement: A simple sketch of a path running across a property to illustrate the concept of a legal right to cross.A simple sketch of a path running across a property to illustrate the concept of a legal right to cross.

Equity: A balance scale graphic with the home’s value on one side and mortgage debt on the other to represent the difference.

3.2 Association

Method: Relate new real estate terms to something familiar.

Example: To remember “appraisal,” think of appraising the value of your favorite personal item, like a cherished watch or piece of jewelry. The idea of determining worth stays consistent.

3.3 Chunking

Method: Group related terms under a common category to reduce mental load.

Concrete Example: You can create study blocks based on specific categories:

Financing Terms: LTV, ARM, PITI, amortization, points, origination fee, equity

Legal Terms: Title, deed, encumbrance, lien, easement, fiduciary

Property Types: Single-family, condominium, townhouse, multi-family, commercial

By focusing on one category at a time, you reduce cognitive overload and can more easily see the relationships among related concepts.

3.4 Spaced Repetition

Method: Revisit your study material at increasing intervals—e.g., 1 day, 3 days, 7 days, 14 days—to reinforce long-term retention.

Tip: Use flashcards or mobile apps like Anki or Quizlet to schedule reviews automatically.

Examples of Real Estate Terms and Memory Tricks

Below are some key real estate terms, their definitions, and suggested memory aids.

Term:Easement

Definition: A legal right to use someone else’s land for a specific purpose.

Memory Trick: Visualization - Picture an “easy” walkway cutting across your neighbor’s lawn, emphasizing that it’s an “easement” granting passage.

(Possible Visual): A property diagram with a dotted line indicating the path.

Term:Amortization

Definition: The process of gradually paying off a debt (mortgage) over time through regular payments.

Memory Trick: Acrostic - Ann Makes Only Regular Payments To Incrementally Zero the balance (AMORTIZ…).

(Possible Visual): A decreasing bar chart showing how principal and interest change over time.

Term:Fiduciary

Definition: A relationship of trust, especially between a real estate agent (or broker) and a client, requiring loyalty and care.

Memory Trick: Rhyme - “The duty to be true, a FIDUCIARY through and through.”

(Possible Visual): Two hands shaking, symbolizing trust.

Term:Title

Definition: A legal document that serves as evidence of ownership of a property.

Memory Trick: Association - Think of the “title” of a book, which declares the book’s name and who wrote it. A property’s title declares who owns it.

Term:Deed

Definition: A written instrument that conveys property from seller to buyer.

Memory Trick: Alliteration - "Deed Delivers Dirt." (Remember: a deed delivers the rights to real property—often referred to as “dirt.”)

Term:Equity

Definition: The difference between the property’s market value and the amount still owed on the mortgage.

Memory Trick: Visualization - Imagine an equal sign (“=”) balancing what you owe on one side and what the home is worth on the other. The balance in the middle is your equity.

(Possible Visual): A simple scale showing “Home Value” on one side and “Mortgage Owed” on the other.

Term:Encumbrance

Definition:A claim, lien, or liability that limits the use or transfer of property.

Memory Trick: Association - Think of “encumbered with worry”; an encumbrance is a burden on the property.

Term:Escrow

Definition: A neutral holding account managed by a third party during a real estate transaction for funds or documents until certain conditions are met.

Memory Trick: Story - Envision a character named “Es Crow” (a crow) perched on a fence, safely holding a shiny key in its beak until the sale conditions are fulfilled.

Mastering real estate terminology doesn’t have to be an uphill battle. By using creative memory techniques—acronyms, mnemonics, visualization, association, chunking, and spaced repetition—you can transform dense vocabulary into readily accessible knowledge. These strategies not only boost your confidence but also elevate your professional credibility.

Remember to practice regularly, find the techniques that best match your learning style, and enjoy the process. Above all, stay motivated by reminding yourself how crucial this terminology is to your success in the real estate industry.

By engaging with these resources and practicing consistently, you’ll become a bona fide real estate terminology expert—and impress clients and colleagues alike. Good luck with your studies, and remember: learning can be fun when you use the right tools!

Love,

Kartik

|

Buying a home is a significant milestone, and for most people, securing a mortgage is a crucial step in the process. Navigating real estate financing can seem daunting as interest rates fluctuate and housing Read more...

Buying a home is a significant milestone, and for most people, securing a mortgage is a crucial step in the process. Navigating real estate financing can seem daunting as interest rates fluctuate and housing markets grow more competitive. Understanding how to navigate the mortgage process is more important than ever, and it's essential to recognize that this journey can vary significantly based on location, economic conditions, and personal circumstances. This article provides essential home mortgage tips and insights to help you make informed decisions on your path to homeownership.

As a new real estate agent fresh out of real estate school, remember this vital principle: be your own best client. While this article is geared toward helping buyers navigate the complexities of qualifying for a mortgage, the advice within applies just as much to you as it does to them. The true path to wealth in real estate isn’t solely in the properties you sell but in the properties you acquire along the way. By investing in real estate, you secure your financial future and gain firsthand experience that will make you a more informed and credible advisor to your clients. Let every transaction remind you that the best investment you can make is in yourself.

Understanding Your Financial Readiness

Before diving into mortgage options, it's crucial to assess your financial readiness. This step is not just important, it's empowering. It involves:

Assessing Your Credit Score

Your credit score determines the interest rates and loan terms for which you qualify. A higher score generally translates to better terms.

To improve your credit score, pay bills on time, reduce credit card balances, and avoid opening new credit accounts unnecessarily.

For instance, a buyer with a credit score of 750 might secure a 5% interest rate, while a score of 650 could lead to a 6.5% rate—a difference that could cost tens of thousands over the life of a loan.

Evaluating Your Budget with the 28/36 Rule

The 28/36 rule is a helpful guideline that can provide you with a sense of direction. It suggests that up to 28% of your gross monthly income should go towards housing expenses, and your total debt should be at most 36% of your gross income.

Determine a comfortable down payment amount while considering other savings goals and expenses, such as emergency funds, retirement savings, and other financial commitments.

Exploring Mortgage Options

Once you have a good grasp of your finances, it's time to explore the different mortgage options available:

Types of Mortgages

Fixed-Rate Mortgages: Ideal for buyers who prefer predictable monthly payments and plan to stay in their homes long-term.

Adjustable-Rate Mortgages (ARMs): These have interest rates that adjust periodically, making them suitable for buyers who plan to move or refinance within a few years. I generally don’t recommend these.

Government-Backed Loans:

FHA loans: Great for first-time homebuyers with lower credit scores or limited down payments.

VA loans: Exclusively for veterans and eligible service members, offering competitive terms and no down payment.

USDA loans: Designed for rural properties, providing low or no down payment options for qualified buyers.

Interest Rates and Loan Terms

Economic conditions and your creditworthiness influence interest rates.

Use online mortgage calculators to compare the costs of a 15-year loan versus a 30-year loan.

For example, "Have you ever wondered how much that extra 0.5% interest rate could cost over 30 years? A quick calculation can show you the impact on your budget."

Preparing Your Mortgage Application

A well-prepared mortgage application can streamline the approval process.

Gathering Required Documents

Lenders typically require proof of income (pay stubs, tax returns), employment verification, credit history, and documentation of assets (bank statements, investment accounts).

Avoiding Common Pitfalls

Refrain from making major purchases or opening new lines of credit while your mortgage application is under review, as these actions can negatively impact your credit score and approval chances.

Finding the Right Lender

When it comes to finding the right lender, don't settle for the first one you come across. Take your time, do your research, and make a decision that you feel confident about.

Shop Around for the Best Rates

Compare interest rates, fees, and loan terms from various banks, credit unions, and mortgage brokers to find the most favorable offer.

Ask the Right Questions

Inquire about lender fees, interest rate lock options, prepayment penalties, and other concerns.

Making the Most of Pre-Approval

Getting pre-approved for a mortgage offers several advantages:

What Pre-Approval Means

A pre-approval indicates that a lender has reviewed your finances and will lend you a specific amount.

Strengthening Your Offer

In competitive real estate markets, being pre-approved demonstrates your seriousness as a buyer and can give you an edge over other offers.

Understanding Closing Costs

Be prepared for closing costs, including appraisal fees, title insurance, loan origination, and more.

Some lenders or sellers may offer to cover part of the closing costs. Feel free to negotiate or inquire about potential discounts.

Reviewing the Fine Print

Carefully review all loan documents before signing to ensure you understand the terms and conditions of your mortgage. This is crucial as it can help you avoid any surprises or misunderstandings later on. Pay close attention to the interest rate, loan term, prepayment penalties, and any other fees or conditions.

Tip: Carefully compare the final Closing Disclosure to your initial Loan Estimate to ensure all terms align as expected.

Securing a mortgage requires careful planning and informed decision-making. By understanding your financial readiness, exploring mortgage options, preparing a strong application, and finding the right lender, you can confidently navigate the process. Remember to get pre-approved, understand closing costs, and review loan documents thoroughly. These home mortgage tips empower you to make sound choices and achieve your homeownership dreams.

Love,

Kartik

|

As a newly licensed real estate agent looking to build a robust client pipeline, you’ve likely heard the buzz about digital marketing channels—social media, paid ads, and content marketing.

Read more...

As a newly licensed real estate agent looking to build a robust client pipeline, you’ve likely heard the buzz about digital marketing channels—social media, paid ads, and content marketing.

However, email marketing is one of the most powerful, often underutilized tools at your disposal. Unlike social feeds that scroll by in seconds, emails land directly in your subscribers’ inboxes, offering a prime opportunity to nurture trust, credibility, and long-term loyalty. Through strategic, personalized emails, you can educate prospects, highlight your unique expertise, and position yourself as a go-to resource in your local market. Over time, these meaningful connections pave the way for loyal clients, repeat business and valuable referrals.

Email marketing is more than just a message—it’s your chance to build enduring relationships that translate into lasting success.

Why Email Marketing Matters for Real Estate Agents

Email marketing stands apart from other channels in several key ways. First, it’s personal. Your message arrives in a lead’s private inbox, free from the noise and distractions of social media. This direct connection lets you address subscribers by name, speak to their interests, and consistently provide valuable information.

Second, email marketing allows for pinpoint targeting. Not every lead is the same. Some may be first-time buyers who need help understanding mortgage options, while others are seasoned investors scouting their next opportunity. By segmenting your lists, you ensure your message resonates, increasing the likelihood of engagement and action.

Finally, emails support long-term relationship building—consistent messages filled with insights and educational content position you as a knowledgeable authority. Over time, this credibility makes clients more inclined to trust you when they’re ready to buy or sell—and more likely to refer your services to friends and family, instilling a sense of hope and optimism in the audience.

Building a Quality Subscriber List

A strong email strategy begins with attracting subscribers who genuinely care about what you offer. Quality outperforms quantity. Rather than stuffing your list with contacts with no genuine interest in real estate, focus on leads who find value in your expertise, reassuring the audience and boosting their confidence in their marketing strategy.

Create compelling lead magnets, which are essentially valuable resources or offers that you provide in exchange for a visitor's contact information. These could be a downloadable “10 Steps to Finding Your First Home” guide or a local market report that simplifies buying. Feature these offers prominently on your website’s landing page, social media posts, and in-person events such as open houses. Highlight the exclusive benefits subscribers will receive—early access to new listings, monthly tips on home maintenance, or insights into market trends. By emphasizing valuable content and sincere interest, you ensure the people on your list genuinely want to hear from you.

Crafting Engaging, Value-Packed Emails

The key to successful email marketing in real estate lies in delivering meaningful, easy-to-consume content. Start with a compelling subject line that sparks curiosity or promises immediate value: “5 Neighborhood Trends You Can’t Afford to Ignore” or “Your Quick Guide to Navigating Closing Costs.” Good subject lines can dramatically improve open rates.

Inside the email, keep messaging concise and organized. Use bullet points, short paragraphs, and strong visuals—such as property images, infographics, or charts showing market trends. Above all, deliver valuable insights, not just sales pitches. Share relevant statistics, offer practical tips, or highlight success stories from past clients who found their perfect home with your guidance. Add a clear call-to-action (CTA) that prompts readers to take the next step: book a consultation, explore a featured listing, or read a more in-depth article.

Segmenting and Personalizing Content

One-size-fits-all emails rarely inspire action. Instead, segment your subscribers based on their interests, homebuying stage, or other factors. For instance, first-time buyers might receive emails on understanding closing costs or securing the best mortgage rates, while sellers might see content focused on home staging and pricing strategies. Investors, on the other hand, might appreciate market forecast reports or rental yield calculators.

Personalization goes beyond using a subscriber’s name. Leverage customer relationship management (CRM) data to tailor content based on user behavior. If someone downloaded a guide on property investing, follow up with emails that explore up-and-coming neighborhoods or tax strategies. The more your emails feel like tailored advice rather than generic broadcasts, the more trust you’ll earn—and the more likely readers will be to engage and eventually convert.

Automating Nurture Sequences and Drip Campaigns

Automation can take much of the heavy lifting out of email marketing. Instead of manually sending emails individually, set up sequences triggered by specific actions. When a new lead subscribes to your list, automatically send a welcome email introducing yourself, explaining your services, and what they can expect from you. Follow up with drip emails over the next few weeks to slowly nurture the relationship.

A typical buyer drip campaign might include:

Step-by-step guidance on the homebuying process.

Timelines for due diligence.

Checklists for mortgage pre-approval.

Meanwhile, a seller sequence might focus on preparing a home for the market, understanding appraisal values, and maximizing the final sale price. When you introduce a call-to-action to schedule a showing or discuss listing options, your subscribers receive a consistent, credible value that warms them to work with you.

Establishing Authority and Trust

Your emails should reflect your expertise and position you as a trusted authority. Consider sending monthly market reports that simplify local real estate trends into easily digestible insights. Offer how-to guides for tackling common homeowner challenges or highlight local community features that make specific neighborhoods attractive.

Include stories of satisfied clients who overcame hurdles in their homebuying journey with your help. Share interviews with mortgage brokers, home inspectors, or interior designers. Host Q&A sessions via email or share recorded webinars that address common concerns. The more you present yourself as a knowledgeable, well-connected professional, the stronger your brand becomes—and the more credibility you create.

Measuring Success and Making Improvements

Data is your compass for continuous improvement. Track open rates (do your subject lines resonate?), click-through rates (are CTAs compelling?), and conversion rates (are leads taking desired actions?). Low open rates might indicate that you need more captivating subject lines, while poor click-through rates suggest that your content or calls to action need refinement.

Analyze unsubscribe rates to determine whether you’re emailing too frequently or providing irrelevant content. Implement A/B tests, a method where you compare two versions of an email or a landing page to see which one performs better, to compare different subject lines, email templates, or CTAs. Continuous monitoring and optimization ensure your email campaigns stay effective and align with your audience's evolving needs.

Advanced Strategies

Once you’ve mastered the fundamentals, consider taking your email marketing to the next level with more advanced tactics. A/B testing, for instance, allows you to compare two versions of a subject line, email copy, or CTA to see which performs better. You might test a data-driven subject line against one that highlights urgency. Over time, these experiments hone your messaging to resonate more deeply with your audience.

Another advanced technique is the use of dynamic content. With dynamic content, the email’s body can adapt based on subscriber attributes. For example, an investor might see rental property tips at the top of the email, while a first-time buyer might see mortgage checklists. This level of personalization enhances the reader’s experience and increases the likelihood of engagement.

Even if you are fresh out of real estate school, embracing email marketing as a newly licensed real estate agent can dramatically boost your visibility, credibility, and client conversion. By building a quality subscriber list, crafting compelling content, segmenting your audience, automating nurture sequences, and positioning yourself as a trusted authority, you’ll attract more leads and nurture them into satisfied clients who drive your business growth.

By embracing strategic email marketing, you’ll build a thriving, sustainable career that stands out in the competitive real estate landscape.

Love,

Kartik

|

Studying for the California Real Estate Exam can feel overwhelming.

According to data from the California Department of Real Estate (DRE), the pass rate often hovers between 40-55% for first-time test Read more...

Studying for the California Real Estate Exam can feel overwhelming.

According to data from the California Department of Real Estate (DRE), the pass rate often hovers between 40-55% for first-time test takers—so

every point matters! One thing that frequently trips students up is how

questions are

|

Imagine waking up on a frigid winter morning to discover your heater has stopped working. Or picture a water heater that suddenly malfunctions around holiday time. Would you be ready to handle the cost Read more...

Imagine waking up on a frigid winter morning to discover your heater has stopped working. Or picture a water heater that suddenly malfunctions around holiday time. Would you be ready to handle the cost and hassle alone, or would a home warranty lift some of that burden?

Fresh out of real estate school, most new real estate agents typically start by working with buyers. As a buyer agent, being able to negotiate with sellers to cover the buyer's home warranty cost is crucial. This ensures protection for the buyer should any issues arise after the escrow closes.

I wanted to delve into home warranties and evaluate whether or not they truly offer peace of mind.

What is a Home Warranty?

A home warranty is a service contract that may cover the repair or replacement of major home systems like appliances, HVAC, plumbing, and electrical systems. Unlike home insurance, which protects against damage from unexpected events like fires or storms, a home warranty covers the normal wear and tear that daily use can inflict on a home.

The Benefits of Home Warranties

Peace of Mind: As new homeowner Sarah J. recounted, "Having a home warranty gave me such a profound sense of security. When my water heater broke, I didn't panic. I just called the warranty company, and they took care of everything." This level of reassurance is what a home warranty can offer.

Budgeting: Home warranties help you avoid unexpected and potentially expensive repair bills. You typically pay a service call fee, but the warranty company covers the rest within the limits of your contract.

Long-term Savings: Consider this: a new refrigerator costs $1,500, and a furnace replacement can easily exceed $5,000. With a home warranty costing around $500-$800 per year and service fees, you could save thousands over the long term. This could be a smart financial move for any homeowner.

Great for Older Homes: A home warranty can be especially beneficial if home warranty can be especially beneficial if you're buying an older home with aging appliances and mechanical and plumbing systems.

Ideal for First-time Homebuyers: New homeowners often need more experience to diagnose and handle home maintenance issues. A warranty simplifies the process by connecting you with qualified service providers.

Potential Downsides of Home Warranties

Coverage Denials: One of the biggest complaints about home warranties is the denial of claims, which can happen due to pre-existing conditions, lack of proper maintenance, or issues outside the contract's scope. Industry data suggests that as many as 20% of claims are denied initially, though some may be approved upon appeal.

Service Issues: Finding qualified technicians and scheduling timely repairs can sometimes be challenging.

Cost vs. Benefit: Weigh the warranty premium and service call fees against the potential repair costs. However, for many homeowners, the peace of mind and protection against catastrophic expenses outweigh these limitations.

How to Choose the Right Home Warranty

Compare Companies: Research different home warranty providers, comparing their coverage options, costs, and customer reviews.

Read the Fine Print: Carefully examine the contract, paying close attention to coverage limits, exclusions, and claim procedures.

Check Customer Reviews: Look for companies with a strong reputation for customer service and fair claim handling.

Ask the Right Questions: Don't hesitate to ask potential providers these key questions:

What is the average response time for service requests?

Are there any limits on the number of service calls I can make annually?

What are the common reasons for claim denials?

Can I choose my service technician?

Home warranties can offer valuable protection and peace of mind, especially for first-time homebuyers or those purchasing older homes. However, weighing the potential benefits against the costs and limitations is crucial. Choosing the proper warranty and understanding your contract thoroughly is key to a positive experience.

Love,

Kartik

|

Embarking on a career in real estate is a thrilling journey, filled with opportunities and challenges. It all begins with understanding and meeting the state licensing requirements, enrolling in a reputable Read more...

Embarking on a career in real estate is a thrilling journey, filled with opportunities and challenges. It all begins with understanding and meeting the state licensing requirements, enrolling in a reputable real estate school, and eventually making your first sale. As you progress, you'll accumulate experience, expand your network, and learn how to guide clients through one of their most significant financial decisions.

Real estate is not just about buying and selling homes. It also involves building trust, solving problems, and helping people reach their financial and personal goals. Knowing your role, possible earnings, and room for growth can help you picture yourself as a helpful expert in your community.

Understanding the Job: Duties and Earnings

Real estate agents help people list, market, and buy properties. Important tasks include:

Assisted sellers in setting the right price and preparing their homes for showings.

Guiding buyers through property visits, inspections, and paperwork.

Handling negotiations about offers, contingencies, and closing dates.

Managing legal documents and disclosures.

Maintaining good relationships with clients, other agents, lenders, and inspectors.

Your earnings in the real estate industry are directly linked to your ability to attract new clients, your dedication to learning, and the strength of your local market. While it's true that new agents might start with modest incomes, those who continuously enhance their skills, effectively market themselves, and build strong client relationships can eventually reach six-figure earnings. This level of success, however, is a result of perseverance, patience, and consistent effort.

Meeting Your State's License Requirements

Each state sets its own rules for getting a real estate license, but most will ask for the following:

Age and Education: You must often be at least 18 and some states might require you to have a high school diploma or equivalent.

Pre-Licensing Classes: You must finish course hours at an approved real estate school. Hours vary by state, usually between 60 and 180 hours.

Background Check: Some states require a check of your criminal history.

Licensing Exam: You must pass the state exam, which covers real estate laws, rules, and basic practices. The exam usually consists of multiple-choice questions that test your knowledge of these areas. It's essential to study the state-specific real estate laws and regulations, as well as general real estate principles, to prepare for the exam.Before signing up for classes, check your state's rules. Knowing what's required will help you move smoothly through the process.

Choosing Between Online and In-Person Real Estate School

Once you meet the basic requirements, you must complete pre-licensing courses. When picking a real estate school, consider online or in-person classes:

Online Schools: These offer flexible schedules and allow you to learn independently. They often cost less, which can help if you are on a tight budget.

In-Person Classes: Traditional classrooms let you talk directly with teachers and classmates. This can help if you learn better through face-to-face contact and want immediate feedback.

Hybrid Schools: Some schools, like Adhi Schools, offer the best of both worlds. They combine the flexibility of online learning with the engagement of live instruction through Zoom calls. This allows you to attend classes from anywhere while still benefiting from real-time interaction with instructors and classmates.

In any case, make sure your state approves the program. A good school will prepare you well for the state exam and the work ahead.

Studying for the Licensing Exam: Tips for Success

Passing the exam is a big step, so it pays to study well:

Study Guides and Flashcards: These tools help you understand complex ideas like property law and financing.

Practice Tests: Take as many sample exams as you can. This will help you get used to the question styles and avoid mistakes.

Consistent Study Times: Set a regular study schedule. Even short, daily review sessions can help you remember key facts.

Extra Help: If you struggle with certain topics, consider taking a test prep course or hiring a tutor who is familiar with the material.

Getting Your License and Finding the Right Brokerage

After passing the exam, you must apply for your license. This usually involves sending in an application, paying fees, and proving that you have finished all required coursework. Once you have your license, it's time to pick a brokerage where you will work under the guidance of a broker.

When choosing a brokerage, consider:

Reputation: A well-known brokerage can give you a strong start.

Training and Support: Look for a brokerage that offers training sessions, mentoring, and marketing help.

Commission Splits: Ask how your sales are divided between you and the brokerage.

Office Culture: A supportive workplace with friendly managers and coworkers can help you learn and grow faster.

From Finding Your First Client to Closing Your First Sale

With your license and a brokerage behind you, the next step is to attract clients. Begin by telling friends, family, and neighbors about your new career. As you gain confidence, use social media, attend local events, and reach out to community groups. Consider choosing a focus—such as working with first-time buyers, luxury homes, or rental properties—to stand out in a crowded market.

Your first sale might feel overwhelming, and things may go differently than planned. Don't worry—every experience, even the rough ones, will teach you important lessons. With each transaction, you'll learn more about your market, improve your negotiation skills, and become more comfortable guiding clients through the process.

Setting Goals and Building a Lasting Career

To become a real estate agent, you must meet your state's licensing rules, choose a reputable real estate school, prepare for and pass the state exam, and join a good brokerage. After that, long-term success depends on constant learning, honest relationships, and careful goal-setting. Remember that reaching your full earning potential takes time and patience. Each step—from the classroom to the closing table—builds the future you want in real estate.

Love,

Kartik

|

The digital classroom is revolutionizing real estate education, offering aspiring agents unprecedented flexibility. But the convenience of online learning comes with a hidden hurdle: the distractions Read more...

The digital classroom is revolutionizing real estate education, offering aspiring agents unprecedented flexibility. But the convenience of online learning comes with a hidden hurdle: the distractions of home. This article unlocks the secrets to transforming your living space into a focused learning sanctuary, ensuring you not only survive but thrive in your online real estate school journey, setting the stage for a successful career.

Different Learning Styles

Everyone processes information a bit differently. Some people are visual learners who benefit from color-coding notes and creating mind maps. Others are auditory learners who learn best by listening to recorded lectures or podcasts. There are also kinesthetic learners, who prefer hands-on activities and physical engagement with the material. When creating your study environment, keep these learning styles in mind:

Visual Learners: Use color-coded notes, diagrams, and visual aids. Post relevant charts or property market infographics in your study area.

Auditory Learners: Record lectures (if allowed) and play them back while taking notes. Consider using noise-cancelling headphones to focus on course audio.

Kinesthetic Learners: Incorporate interactive elements like explaining real estate concepts to a friend or family member.

By tailoring your space and study approach to your natural learning style, you’ll maximize comprehension and retention as you progress through our online real estate courses.

Setting Up Your Workspace

Choose the Right Location

One of the first steps in setting up a productive home study environment is finding a dedicated space. This should be an area in your home that is relatively free from foot traffic and can be reserved solely for study purposes. If you have an unused spare room, convert it into your personal "real estate school" office. If space is limited, carve out a corner in your living room or bedroom where you can add a desk and a comfortable chair. The key is to ensure you have enough room for your study materials, computer, and other essentials without feeling cramped.

Invest in the Necessary Equipment

Just as a real estate agent needs the right office tools to close deals, you’ll want to equip your home workspace with the essentials. A reliable computer or tablet, a high-speed internet connection, and an ergonomic chair are non-negotiables. Consider a desk with enough surface area to spread out textbooks, notes, and other real estate exam study materials. An external monitor can also be beneficial for those enrolled in online real estate courses, as it allows you to keep multiple windows open for research, note-taking, and real estate course videos.

Optimize Lighting

Proper lighting can make a world of difference in your productivity. If possible, position your desk near a window so you can take advantage of natural light. Not only does natural light help reduce eye strain, but it can also boost your mood and energy levels—both important factors for online learning of real estate concepts. If you don’t have sufficient natural light, invest in a good desk lamp or overhead lighting that simulates daylight. Avoid harsh glare on your screens by using blinds or curtains when necessary.

Keep It Organized

Maintaining an organized workspace helps you stay in control of your study sessions. Use shelves, drawers, or desk organizers to store textbooks, stationery, and other supplies. Keep digital files neatly arranged in folders on your computer, and consistently back up important documents. A clutter-free space promotes clearer thinking and allows you to focus on mastering real estate concepts rather than scrambling to find misplaced study materials.

Minimizing Distractions

Set Boundaries with Family and Roommates

When you’re juggling daily obligations while attending an online real estate school, establishing boundaries is crucial. Let your family or roommates know your real estate study schedule in advance. Post a sign on your door or designate times when you’re “off-limits” to minimize interruptions. If you have children, consider scheduling study times during their naps or after they’ve gone to bed.

Manage Digital Distractions

Social media notifications and email alerts can be major productivity killers. Turn off non-essential notifications on your phone and computer while studying. If you need extra help staying focused, use popular website-blocking tools which can restrict access to distracting sites for a set amount of time.

Create a Distraction-Free Zone

Pets, household chores, and a TV playing in the background can all disrupt your concentration. If possible, choose a study area away from the TV or your pet’s favorite hangout. Keep a to-do list nearby to jot down pressing household tasks that pop into your mind. This will let you quickly note them and return to your studies without lingering distractions.

Scheduling Effectively

Implement Time-Blocking

Time-blocking involves dividing your day into distinct blocks dedicated to specific tasks—like reading real estate textbooks, watching video lectures, or taking practice quizzes. This approach keeps you on a structured path and prevents overwhelm. It also mirrors the schedule you might keep once you’re a practicing real estate agent, who often juggles showings, client meetings, and administrative tasks.

Set Specific Study Goals

Whether you’re learning about property law, real estate finance, or marketing strategies, having clear goals for each study session can help you stay engaged. For example, aim to read a certain number of pages in your textbook, review a specific chapter, or practice a set of exam questions during one study block. When you set achievable mini-goals, it’s easier to measure your progress and maintain momentum.

Incorporate Breaks Wisely

Taking regular breaks can boost your productivity, allowing you to return to your tasks with renewed focus. While studying for your online real estate courses, schedule short 5–10-minute breaks every hour to stretch, hydrate, or briefly check personal emails. Plan longer breaks—20–30 minutes—every few hours for meals or a quick walk. Breaks not only help you recharge but also prevent burnout, a common pitfall for students immersed in rigorous online learning schedules.

Stay Consistent

Once you’ve created a schedule that works for you, stick to it. Consistency builds discipline and helps turn studying into a habit rather than a chore. This discipline will be invaluable once you transition into your career, where self-management is essential for staying on top of listings, client communications, and real estate market updates.

Tips for Staying Motivated

Reward Yourself

Motivation often wanes when you’re studying alone at home. Combat this by rewarding yourself when you hit key milestones—like completing a unit in your online real estate courses or scoring well on a practice test. Rewards can be as simple as indulging in a favorite snack, watching a short show, or treating yourself to coffee from your favorite café.

Visualize Your Future Success

Sometimes, staying motivated is as simple as remembering your end goal. Visualize yourself successfully passing your real estate exams and flourishing as a confident real estate agent. Imagine touring properties with clients, closing deals, and advancing your career. Keeping the bigger picture in mind can push you to stay on track, even during tougher study sessions.

A productive home study environment is integral to your success in our online real estate school. By setting up a dedicated workspace, minimizing distractions, creating a well-structured schedule, and staying motivated—while also considering your unique learning style—you’re laying the groundwork for both academic achievements and a thriving real estate career. Developing these habits now will benefit you long after you’ve passed your licensing exams.

Ready to take the first step toward a successful career in real estate? Enroll in our online real estate courses today and experience a flexible, comprehensive curriculum designed to fit your lifestyle and career aspirations. Turn your at-home study setup into a launching pad for achieving your real estate goals!

Love,

Kartik

|

Older homes whisper stories of the past, offering a unique sense of history and character that many find irresistible. The charm of original hardwood floors, intricate crown moldings, built-in cabinetry, Read more...

Older homes whisper stories of the past, offering a unique sense of history and character that many find irresistible. The charm of original hardwood floors, intricate crown moldings, built-in cabinetry, and stained glass windows are just a few examples of the architectural details that contribute to this character. However, the reality of owning an older home can present unexpected challenges. While those creaky floorboards might add to the charm, they could also signal underlying structural issues.

While there is no substitute for a physical inspection by a competent professional, I wanted to write an article on how to navigate some of the complexities of buying an older home to ensure your dream home becomes something other than a money pit. Because lots of our real estate school students dream of selling unique and historic homes it's important to keep in mind that it’s not just about the charm, it's also about being cautious and prepared.

Structural Integrity

Foundations: A solid foundation is crucial. Look for telltale signs like cracks, shifting, or evidence of water damage. Uneven floors, doors that stick, and cracks in the walls, particularly above windows and doors, can all point to foundation problems.

Cracks: Imagine the foundation as the base of a LEGO structure. If that base cracks or shifts, the LEGO bricks above will no longer fit together neatly. Cracks in walls, especially diagonal ones spreading from corners of windows or doors, show that the house's frame is being pulled out of shape by movement in the foundation below.

Uneven Floors: A sinking or uneven foundation can cause the floor joists above to sag or become misaligned. This leads to sloping or bouncy floors. Think of it like a table with uneven legs – it wobbles.

Sticking Doors: When a foundation shifts, it can distort the door frames. This makes doors difficult to open or close because they no longer fit squarely within the frame. It's like trying to fit a puzzle piece into the wrong spot.

Checklist:

Are the floors level?

Do doors and windows open and close smoothly?

Are there any visible cracks in the foundation walls?

Is there any evidence of water damage in the basement or crawlspace?

Roof: The roof is your first defense against the elements.

Checklist:

What is the age of the roof? (And what is the typical lifespan for that roofing material? - e.g., asphalt shingles typically last 20-30 years)

Are there any missing, damaged, or curled shingles?

Are there any signs of sagging or unevenness in the roofline?

Are there any signs of moss or algae growth? (This can indicate moisture problems.)

Are the gutters and downspouts in good condition? (Proper drainage is essential.)

Is there any evidence of water damage in the attic? (Look for stains, mold, or rot.)

Walls and Ceilings: Inspect walls and ceilings for cracks, water stains, or bowing. These imperfections could indicate structural issues, water damage, or poor maintenance.

Plumbing and Electrical Systems

Common Plumbing Problems in Older Homes

Plumbing: Older homes may have outdated plumbing systems, such as galvanized pipes, and be prone to corrosion and leaks. Inquire about the age of the plumbing and look for signs of leaks, low water pressure, or discolored water.

Checklist:

What type of plumbing pipes are used in the home?

What is the age of the plumbing system?

Are there any visible leaks or signs of water damage?

Is the water pressure adequate in all fixtures?

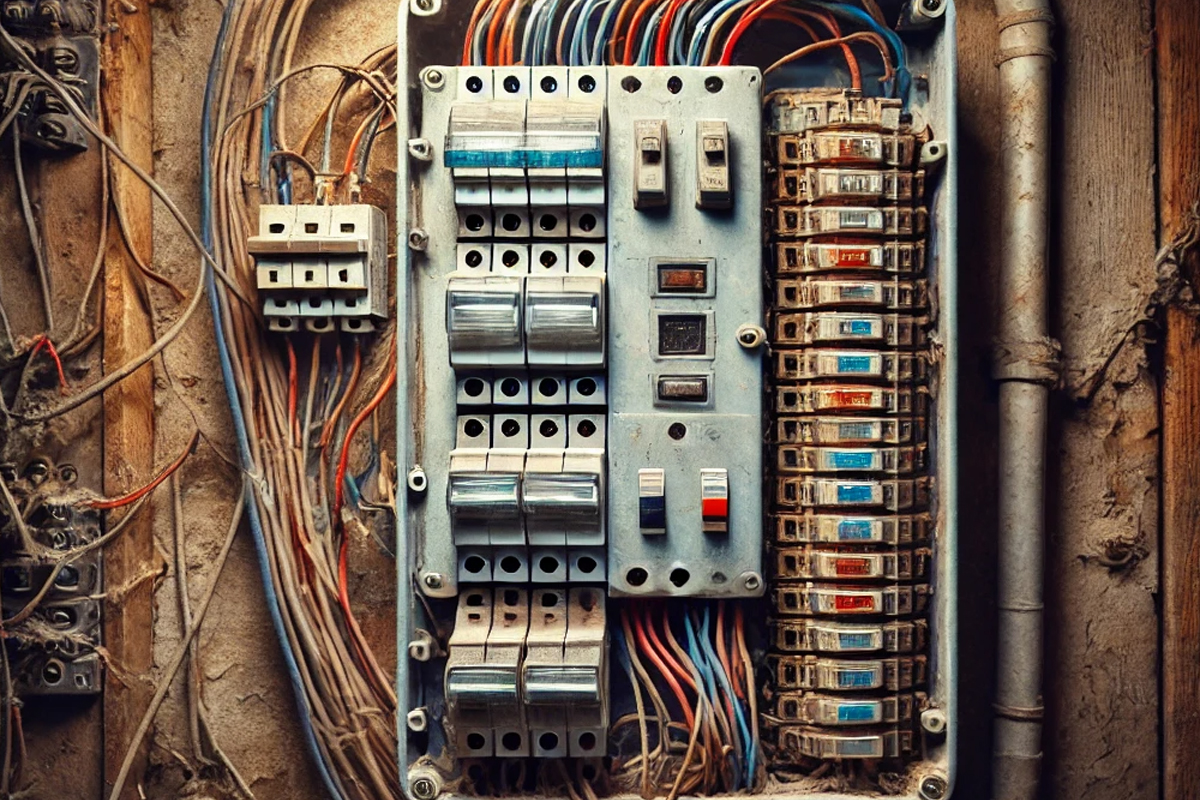

Electrical Safety Concerns

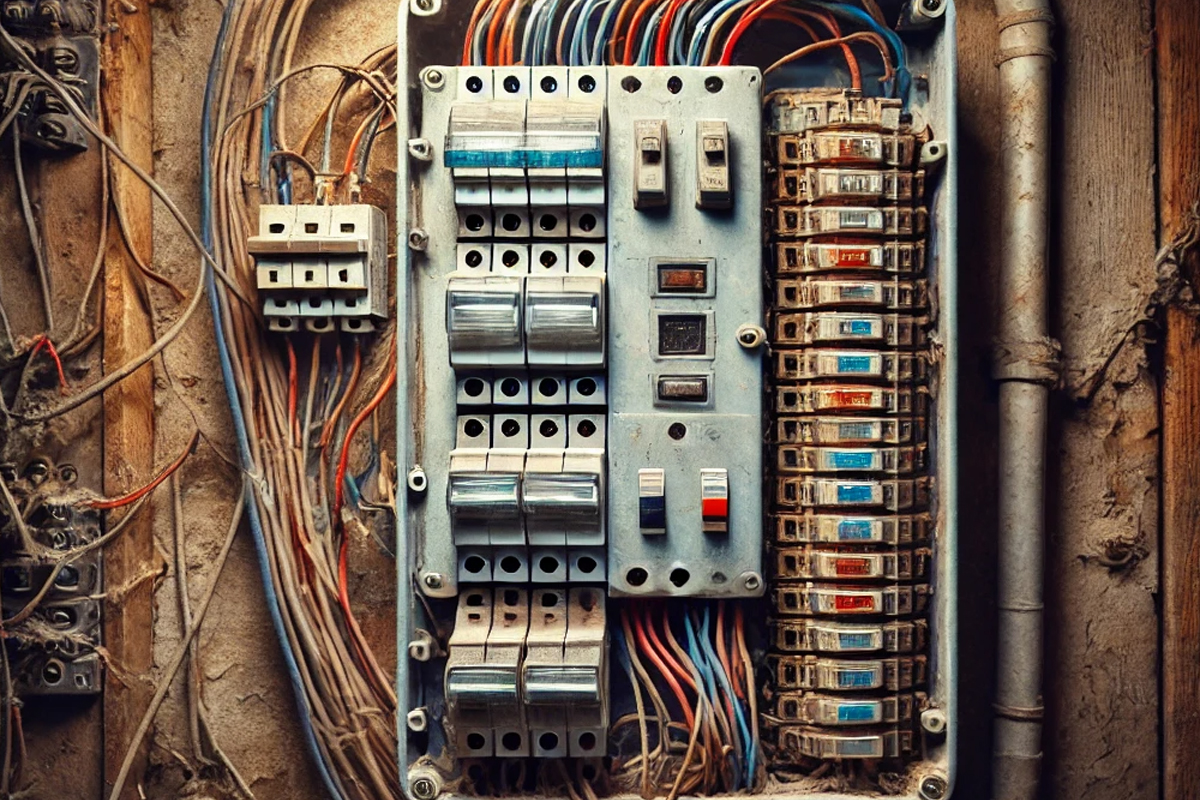

Electrical: An outdated electrical panel can be a safety hazard. Evaluate the panel for its capacity and age. Look for obsolete wiring (like knob-and-tube wiring), insufficient outlets, and any signs of electrical problems, such as flickering lights or frequent circuit breaker trips.

Knob and tube wiring is an old type of electrical wiring that was commonly used in homes from the late 1800s to the early 1900s. You can recognize it by its white ceramic knobs and tubes, which help hold and protect the wires.

The knobs are used to keep the wires attached to the wooden beams in the house, while the tubes are used when the wires need to pass through those beams. The system doesn't have a ground wire, which is used in modern wiring to help protect against electrical shocks and fires.

Because it's so old, knob and tube wiring doesn't meet today's safety standards and can't handle the amount of electricity we use now with all of our gadgets and appliances. That's why it's usually replaced if found in homes today, to make sure everything is safe and works well with modern electricity needs.

Checklist:

What is the age of the electrical panel?

What is the amperage of the electrical service?

Are there any signs of outdated wiring?

Are there enough outlets and circuits to meet your needs?

Hazardous Materials

Asbestos: Asbestos was commonly used in insulation, flooring, and siding in older homes. If you suspect asbestos-containing materials, hire a qualified professional for testing and abatement. Recent regulations have focused on safer removal methods to minimize health risks.

Lead Paint: Homes built before 1978 may contain lead-based Paint, which can be hazardous, especially for children. Lead paint testing and proper reduction are crucial. Modern encapsulation methods offer compelling alternatives to complete removal in some cases.

Heating, Ventilation, and Air Conditioning (HVAC)

System Age: HVAC systems have a limited lifespan, typically 15-20 years. Determine the age of the system and consider its remaining years of service. Older systems are less efficient and more prone to breakdowns.

Efficiency: Pay attention to signs of inefficient operation, such as uneven heating or cooling, drafts, and high energy bills. Consider upgrading to a modern, high-efficiency system to save money and reduce environmental impact. Look for systems with high SEER (Seasonal Energy Efficiency Ratio) and AFUE (Annual Fuel Utilization Efficiency) ratings.

Insulation and Energy Efficiency

Insulation Quality:

Inspect the attic, walls, and basement for adequate insulation.

Look for sufficient insulation depth (e.g., at least 12 inches in the attic) and check for any signs of moisture or pests.

Consider the type of insulation (e.g., fiberglass batts, blown-in cellulose) and its R-value, which indicates its thermal resistance. The higher the R-value, the more effective the insulation.

Poor insulation leads to higher energy bills and uncomfortable living conditions.

Windows and Doors: Check for drafts around windows and doors. Single-pane windows are notorious for heat loss. Consider upgrading to energy-efficient windows and doors to improve comfort and reduce energy consumption.

Potential for Renovations and Upgrades

Local Regulations: Research local zoning laws and building codes, especially if the home has historical status, as renovations might be restricted or require special permits.

Costs vs. Value: Get estimates for any necessary renovations and upgrades. Consider the potential return on investment and whether the improvements will significantly increase the home's value.

Financing Renovations: Explore financing options for renovations, such as home equity loans, personal loans, or government programs that offer incentives for energy-efficient upgrades.

Checking for Pest Infestations

Common Pests: Be vigilant for signs of termites (mud tubes, wood damage), rodents (droppings, gnaw marks), and other pests like carpenter ants (sawdust-like frass).

Signs of Infestation: Check for evidence of past pest control treatments. A history of infestations could indicate ongoing problems.

Water Damage and Mold

Signs of Damage: Look for water stains on ceilings, walls, and floors. Mold growth and musty odors are also red flags.

Sources of Water Damage: Inspect the roof, gutters, and drainage systems. Inquire about any history of flooding or leaks.

Legal and Insurance Issues

Property History: Research the property's history for past insurance claims, disclosures by the seller, and any known issues.

Insurance: Ensure that you can obtain homeowners insurance for the property. Older homes may present challenges or higher premiums due to age and potential risks.

Hiring a Professional Inspector

When hiring a home inspector, it's important to ask the right questions to ensure a thorough inspection. Here are some key questions to consider:

What is your experience with older homes?

What specific areas will you be inspecting?

Can you provide references from previous clients?

How long will the inspection take?

When will I receive the inspection report?

Choosing an Inspector: Select a qualified and experienced home inspector. Ask about their credentials, what they look for, and whether they have experience with older homes.

Understanding the Inspection Report: Carefully review the inspection report. Pay close attention to any significant issues and ask the inspector to explain any findings you need help understanding.

California specific pro-tip: In California, there is no state licensing requirement for home inspectors. This means that home inspectors in California are not regulated by any state agency, unlike in other states where inspectors must be licensed. As a result, the burden often falls on the consumer to ensure they are hiring a qualified and experienced inspector. It’s recommended to look for inspectors who are certified by reputable organizations, such as the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI), as these certifications typically require passing an exam, completing a certain number of inspections, and adhering to a strict code of ethics and standards of practice.

Common Problems by Era

Victorian Homes (pre-1900) are often characterized by knob-and-tube wiring, asbestos insulation, and foundation issues due to their age.

Mid-Century Homes (1950s-1960s): These homes may feature outdated plumbing, such as galvanized pipes, and are known for using aluminum wiring, which can pose a safety hazard.

Buying an older home can be a rewarding experience, but it's essential to approach the process with realistic expectations and a keen eye for potential problems. By conducting thorough inspections, consulting professionals, and addressing any issues proactively, you can minimize risks and enjoy the unique charm and character of your older home for years to come.

Love,

Kartik

|

Real estate school is a critical step towards becoming a successful real estate agent. It's more than just a mandatory hurdle to get your real estate license; it provides a solid foundation for a thriving Read more...

Real estate school is a critical step towards becoming a successful real estate agent. It's more than just a mandatory hurdle to get your real estate license; it provides a solid foundation for a thriving career in the real estate industry.

Think of it as specialized training for a complex field. Just as a doctor needs medical school, aspiring real estate agents need comprehensive education to navigate the intricacies of property transactions. Real estate school offers a structured curriculum covering essential topics like contract law, property rights, financing, and appraisal. These courses equip you with the knowledge and skills needed to not only pass your licensing exam, but also to confidently represent clients and handle the complexities of real estate deals.

Beyond the textbook knowledge, real estate school offers valuable professional development. You'll gain insights from experienced instructors, network with future colleagues, and learn practical strategies for building your business. This supportive environment can be crucial in launching a successful career, whether you're interested in residential, commercial, or specialized real estate.

So, while fulfilling licensing requirements is essential, real estate school offers much more than just exam preparation. It's an investment in your future, providing the knowledge, skills, and professional connections to excel in the dynamic world of real estate.

The Licensing Process, State Regulatory Bodies, and Finding State-Specific Resources

Every state in the U.S. regulates its real estate industry, setting education, licensure, and professional conduct standards. Common regulatory bodies include your state’s Department of Real Estate or Real Estate Commission. While specifics vary, the general pathway is consistent:

Meet age and other prerequisites.

Complete the required pre-licensing education from a recognized real estate school.

Pass the state’s real estate licensing exam.

Apply for and receive your license.

Affiliate with a licensed brokerage.

These regulatory agencies ensure that agents possess the minimum knowledge and ethical grounding to help consumers make informed property decisions. Before choosing a real estate school, verify that it’s approved by your state’s regulatory authority, ensuring the program meets the necessary standards for licensure.

State-Specific Information

Because licensing requirements vary widely, it’s essential to consult your state’s official website or trusted industry associations for details. For example, California’s Department of Real Estate, the Texas Real Estate Commission (TREC), and the New York Department of State Division of Licensing Services provide up-to-date course requirements, exam details, and continuing education mandates. Many states maintain searchable online databases where you can confirm that your chosen real estate school is accredited. Some real estate schools also provide state-specific study guides and preparation courses tailored to local laws, ensuring you’re ready to meet your region’s particular standards.

Core Subjects Taught at Real Estate School

So, what exactly is real estate school teaching you? The curriculum is designed to ensure you have a solid understanding of the industry:

Real Estate Principles and Practices:

Learn about property rights, ownership types, land use controls, and fundamental contract law. You’ll learn how properties are bought, sold, leased, and transferred.

Real Estate Law:

Every agent must understand the legal framework that governs property transactions. Topics include state-specific laws, consumer protection, disclosures, fair housing regulations, and ethical standards. This is often where the curriculum gets more granular depending on your state, as each jurisdiction might have unique disclosure rules, zoning laws, and documentation requirements.

Real Estate Finance and Valuation:

Explore the fundamentals of mortgages, interest rates, credit requirements, and appraisal processes. A firm grasp of finance helps you guide clients through the complexities of securing loans and evaluating property worth.

Delving Deeper: Different Types of Real Estate Licenses and Key Regulations

While the initial focus often centers on becoming a general real estate salesperson or agent, there are additional licensure options you can pursue. Depending on the state, you may find:

Broker’s License: Allows greater autonomy, including managing a brokerage and supervising other agents.

Property Management Certification or License: Some states require a separate credential for managing rental properties and dealing with tenant issues.

Appraisal License: If you’re interested in property valuation, you need specialized licensing and certification to appraise properties legally.

Beyond these credentials, agents must stay current with ever-evolving state and federal regulations, from environmental disclosures to anti-discrimination and fair housing laws. Understanding these regulations is crucial not only to remain compliant but also to provide knowledgeable guidance to clients.

Timeframes and Costs for Completing Real Estate School

The time commitment for finishing real estate school varies by state and program format. Generally, you can expect between 60 and 180 hours of coursework. If you choose an online real estate school, you may have more flexibility to study at your own pace. Some students complete their required hours in a few weeks, while others spread it over several months.

Tuition can range from a few hundred to several thousand dollars, depending on location, accreditation, and program comprehensiveness. While cost is a consideration, remember that attending a high-quality, accredited program can significantly affect how prepared you feel for your exam and future career.

Expanding Career Paths in Real Estate

While many newly licensed agents begin with residential sales, there are numerous other career paths in the real estate industry, each with its unique challenges and rewards:

Commercial Real Estate: Involves working with office buildings, retail centers, and industrial properties.

Property Management: Overseeing rental units, tenant relations, maintenance, and ensuring compliance with local housing laws.

Real Estate Appraisal: Providing objective, expert valuations of properties for lenders, buyers, sellers, and investors.

Real Estate Development: Involves scouting land, planning projects, securing permits, and managing the construction or renovation of properties.

Real Estate Investment and Portfolio Management: Helping clients buy, hold, and sell investment properties to maximize returns.

By exploring these different facets, you can find a specialty that aligns with your strengths, interests, and long-term career goals.

Tips for Choosing the Right Introductory Program

When selecting a real estate school, consider the following factors:

Accreditation and Approval:

Choose a program approved by your state’s regulatory body. This ensures that the coursework meets the necessary standards for licensure, effectively preparing you for the exam and your future career.

Curriculum Quality:

Look for a curriculum that covers all core subjects thoroughly. Some schools also offer exam prep materials, study guides, or practice tests tailored to your state’s exam structure and content.

Instructor Credentials:

Instructors with industry experience can provide invaluable insights, real-world examples, and practical tips. Their guidance can help you grasp and apply complex concepts to future scenarios.

Learning Format and Schedule:

An online real estate school may be the best fit if you have a busy lifestyle. If you prefer face-to-face interaction, an in-person class could be more suitable. Consider your learning style, scheduling needs, and whether the school offers flexible pacing or evening/weekend classes.

Student Support Services:

Look for schools offering additional support, such as one-on-one coaching, Q&A sessions, or responsive customer service. Good support can keep you motivated and on track to complete your coursework.

Internal References for Further Learning

As you move forward, explore related topics like how to become a real estate agent in more detail or consider the benefits of an online real estate school for increased scheduling flexibility. You should learn about specific state real estate license requirements, effective real estate exam preparation strategies, and how to navigate industry regulations. This layered approach to learning will strengthen your path to becoming a licensed professional.

Your Next Steps Toward Enrollment

Attending real estate school is a foundational step in launching a career in the property industry. You’re already ahead of the curve by understanding what real estate school is, how the licensing process works, and what subjects you’ll study. Now, research state-specific guidelines, compare schools (find a good one like ADHI Schools), and consider which career path in real estate resonates with you. With the proper educational support and a deeper understanding of industry nuances, you’ll be well on your way to earning your license and building a successful, fulfilling career in real estate.

Love,

Kartik

|