At its core, a contingency is a condition that needs to be met before an offer like a real estate transaction is allowed to proceed. From a certain perspective it's a bit like a safety net and it's far Read more...

At its core, a contingency is a condition that needs to be met before an offer like a real estate transaction is allowed to proceed. From a certain perspective it's a bit like a safety net and it's far more important than people realize. For the sake of example, let's say a home buyer visits a property that they absolutely fall in love with. After quick negotiations with the seller, they agree to the purchase price of $350,000. Contracts are drawn up, documents are signed and an initial deposit is handed over. Everything proceeds as it should, until the appraisal comes in... and all parties find out that the house is only worth $300,000. What, in that situation, do you do?

If they had an appraisal contingency in the contract, the buyer would walk away without a care in the world. An appraisal contingency means that if the home you want to buy doesn't appraise for the amount that you've already agreed to pay, you get to walk away from the deal with your deposit in hand. This is because an appraisal determines the fair market value of the home you're trying to buy.

All told, they're a hugely important part of the real estate process for a wide range of different reasons, all of which are worth exploring.

How Does the Appraisal Contingency Protect You?

As stated, the purpose of an appraisal contingency is to protect both the buyer and the lender from overpaying for home. No lender will ever want to lend someone more money than a home is worth because from the moment that buyer gets the keys, they'd immediately be underwater. Likewise, no home buyer should ever want to be in that situation because part of the reason you purchase property in the first place is for equity - something that you wouldn't have in that situation.

During the appraisal process, a licensed and trained professional will come to the property in question for what is essentially a physical, in-person inspection. They'll take into consideration specifics like the condition of the outside and inside, the size of the yard, home improvements that have been recently made and more - all in an effort to determine the current fair market value of the property. They'll also take a look at any recent renovations that have been made, or additions that have been built since the last time the home was appraised.

Note that an appraisal is not the same thing as a home inspection and they should not be treated as such. They're similar, to be fair, but they serve different purposes.

Overall, these contingencies protect people financially if there's a serious difference in value between what the home is worth and what they're actually being asked to pay.

When NOT to Use an Appraisal Contingency

Having said all of that, there are a few key situations when using an appraisal contingency as part of a real estate transaction may not be a good idea.

Chief among them is if you're buying when it is a seller's market - particularly one that is as active as it is right now. A seller's market, as the name suggests, means that there are often multiple offers for a single some and buying competition is high. Right it's extraordinarily high - driven in large part by the combination of historically low interest rates and the scarcity of inventory across the country. Things have gotten to the point where it's not uncommon to hear about a situation where a buyer doesn't just waive an appraisal contingency - they waive a home inspection as well. Obviously, this won't always be the case - but it's also the perfect example of when an appraisal contingency will probably lose you a home.

When a seller has the ability to choose between multiple, similar offers in a market that favors them greatly, they're obviously going to choose the one that is the most beneficial to themselves. Any offer that comes with strings attached like an appraisal contingency is obviously less appealing to that person. If you really love a home, you can strengthen your offer by waiving your appraisal contingency. You must also, however, be willing to risk a lower appraisal when that day comes.

You may also consider waiving an appraisal contingency if you're buying a home with cash. Cash sales don't actually require an appraisal because there is no lender involved to deny a mortgage if there is a big difference between what the home is worth and what you're paying for it. Obviously, you could always run the risk of overpaying to begin with - but so long as it's a risk you're willing to take on, this would be considered appropriate.

In the end, the appraisal contingency is one of the more complicated parts of the real estate process - but it's also one of the more important for the protections that it offers. It's also a perfect example of why it's so important to work with a trusted real estate professional to begin with. They can help navigate the market, helping buyers to understand when and why to use things like the appraisal contingency and others. It's just another in a long line of examples of how they assist home buyers in enjoying all the benefits of this process with as few of the potential downsides as possible. If you would like to become a real estate agent , read our success stories to learn more about what the real estate career is like.

Love,

Kartik

|

The California real estate market has been remarkable in recent years, with a severe inventory shortage and historically low mortgage rates fueling one of the strongest housing markets in generations. Read more...

The California real estate market has been remarkable in recent years, with a severe inventory shortage and historically low mortgage rates fueling one of the strongest housing markets in generations. As a result, navigating this hot sellers' market can be challenging for homebuyers, and as a real estate agent, it's your responsibility to help them avoid common mistakes. To further your real estate education, consider enrolling in a real estate school or taking online real estate classes. Remember to check out real estate exam prep resources as well.

One of the most critical errors homebuyers make in a hot market is hesitation. Properties sell rapidly, often before they're officially listed, and bidding wars can erupt within hours. Prepare your clients for this reality by emphasizing the importance of making fast, decisive (but not impulsive) choices. Additionally, if you're considering entering the real estate industry and are wondering how to get your real estate license, we have plenty of resources are available to help.

Set an appropriate budget from the beginning

Another common pitfall is failing to search for homes within a client's budget. Although market activity has inflated home values, homebuyers must stick to a realistic price range. Encourage your clients to establish a maximum budget early on and remind them to stay within those limits when searching for comparable properties.

When embarking on the journey of purchasing a home, it's essential to establish a budget before you begin your search. Setting a budget beforehand allows you to make informed decisions and avoid financial strain, ensuring a smoother and more enjoyable home-buying experience.

One of the primary reasons for setting a budget first is the ability to narrow your focus on properties that fall within your financial means. This targeted approach saves time and energy, as you will only waste valuable resources viewing homes within your reach. Furthermore, by understanding your budget constraints, you can identify homes with the most desirable features within your price range, ultimately leading to greater satisfaction with your final choice.

Additionally, having a predetermined budget in place helps prevent emotional decision-making. When you encounter a dream home beyond your financial capacity, it can be tempting to stretch your budget and make an impulsive offer. However, overextending your finances can result in long-term consequences, such as difficulty meeting mortgage payments or sacrificing other financial goals. By committing to a budget from the outset, you can resist the allure of unaffordable properties and maintain a disciplined approach throughout the home-buying process.

Finally, setting a budget before house hunting gives you a strong negotiating position. With a clear understanding of your financial limits, you can confidently make offers and negotiate with sellers, knowing you are making a well-informed decision. This confidence can enhance your credibility in the eyes of sellers and potentially lead to more favorable negotiation outcomes. In conclusion, establishing a budget before looking for homes is the right strategy for prospective homebuyers. By focusing on properties within your means, avoiding emotional decisions, and strengthening your negotiating position, you can ensure a successful and satisfying home-buying experience.

Don’t Act Out Of Impulse

The urgency of a hot market can also lead to impulsive decisions, with clients quickly making offers on dream homes they can't truly afford. As a real estate agent, it's your job to help clients maintain perspective and make informed choices, even in the face of rapid market movements.

As a Realtor, it is crucial to guide clients through the home-buying process and help them avoid making impulsive decisions. While the excitement and anticipation of purchasing a new home can be overwhelming, it is essential to consider the long-term implications of such a significant investment. Impulsive decisions can result in unforeseen challenges and financial strain, ultimately detracting from the client's satisfaction with their new home.

One of the primary risks of impulsive decision-making is the potential to overlook crucial details about a property. In haste to secure a seemingly perfect home, clients may need to pay more attention to thorough inspections, research on the neighborhood, or a careful review of the property's history. Failing to consider these factors can lead to unexpected issues, such as costly repairs, disputes with neighbors, or declining property values. By encouraging clients to take a measured approach to their home search, they are more likely to make a well-informed decision and enjoy long-lasting satisfaction with their investment.

Moreover, impulsive decisions can lead to financial strain and compromise a client's financial health. When clients become enamored with a home beyond their budget, they may be tempted to stretch their finances and make a hasty offer. Overextending financially can result in difficulty meeting mortgage payments, an increased risk of foreclosure, or sacrificing other critical financial goals, such as retirement planning or saving for a child's education. By guiding clients to remain focused on their predetermined budget and carefully evaluating each property, they can avoid financial pitfalls and ensure a successful, stable homeownership experience.

Don’t Skip the Home Inspection

Another common mistake is forgoing a professional home inspection. A thorough inspection can reveal critical issues with a property, such as structural problems, outdated electrical systems, or potential safety hazards. Skipping this step can lead to costly repairs and unexpected problems after moving in. Homebuyers should always invest in a reputable home inspector to ensure they make an informed decision and protect themselves from potential financial pitfalls.

Keep Additional Expenses In Mind

Many homebuyers focus solely on the purchase price of a home and need to account for the myriad of other expenses associated with homeownership. These include property taxes, homeowners insurance, maintenance costs, and homeowners association (HOA) fees. Neglecting to consider these expenses can lead to financial strain and may result in buyers purchasing a home they cannot truly afford. Homebuyers must research and budget for all related expenses before making an offer on a property.

Ultimately, both you and your clients want the best possible outcome. Guiding someone through the largest purchase of their life is a rewarding and fulfilling experience as a real estate agent. If you're considering entering the industry, visit ADHI Schools to get started on your real estate pre-licensing courses and take the quiz:Should I become a real estate agent?

Love,

Kartik

|

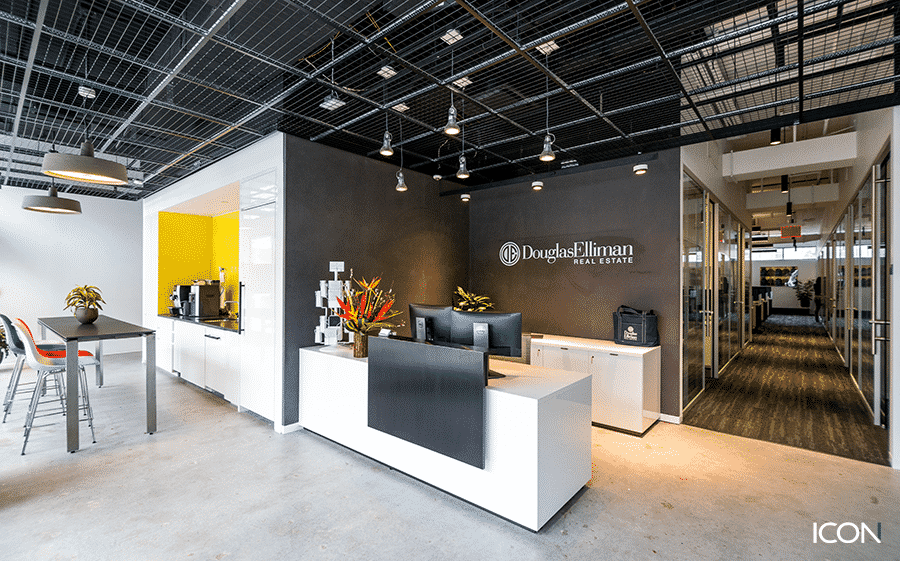

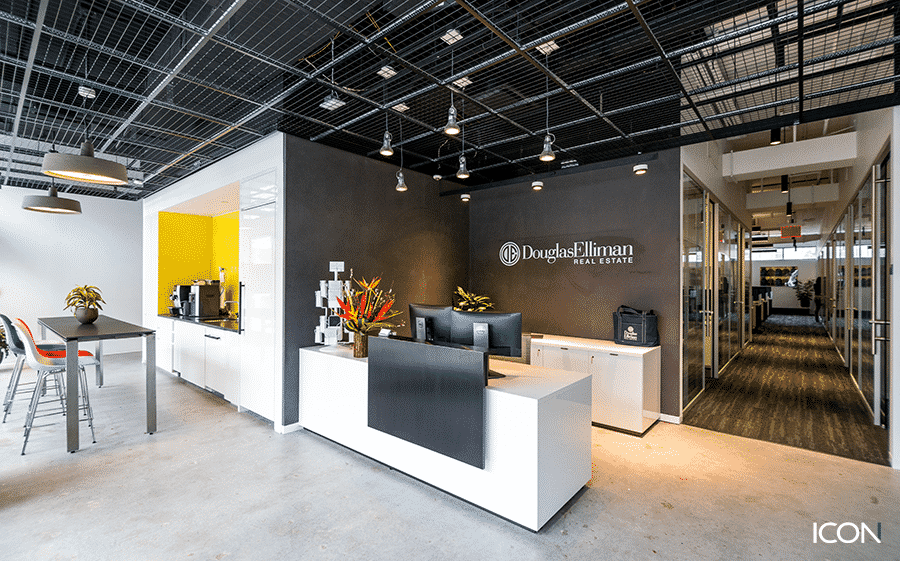

Before making a move from one brokerage to another, be clear about your motivations and what is driving your desire to make the change. Define the work culture you want. If you prefer to work with a small Read more...

Before making a move from one brokerage to another, be clear about your motivations and what is driving your desire to make the change. Define the work culture you want. If you prefer to work with a small company with close relationships with your colleagues, you should look for a brokerage that has that kind of cultures and do research accordingly. See how each brokerage differs and go with the one that fits your needs the most.

If you want an all-business atmosphere, you’ll want to look into the brokerages that are business focused with little to no interaction between colleagues. If you like to work and just do your thing independently, find a brokerage that will fit that need and help you stay focused on business. It’s important to know how the company’s culture, values, and business approaches can affect your ability to succeed there.

An important aspect of brokerages you should consider is the leadership. You should examine the leadership at every level. What is their reputation within the industry and their organization? Ask questions like what does the new brokerage offer that will make you even more successful? Are they forward thinking? Forward-thinking business leaders don't see employees as just putting in the required hours. They see people who are essential to the success of the business. A forward thinking business leader will focus on developing the knowledge and skills of an individual and get them to a place where they can take on more responsibility and leadership roles of their own.

Business support is critical when it comes to running your real estate business. Look into the kind of business support the brokerage offers such as percentage splits, mentorship, technology, and resources. While most realtor’s want the highest pay possible, a higher percentage split should be considered, but should not be the most important decision factor. You should be satisfied with the split you are offered, and you should ask what opportunities there are to earn a higher split. When doing your research, also consider technology and how the right technology can help you. With the right technology, real estate agents can streamline their process to better serve clients. Using innovative tools and services can help you increase efficiency and gain a competitive advantage to close more deals. Email marketing platforms, CRM systems, and other apps are essential in today’s digital world.Make sure the brokerage not only offers these technology services for their agents but look into their efficiency as well.

Before interviewing brokerages, you should have a clear understanding of what kind of support will be most critical to you. What you are looking for in the new brokerage and how they can be the best support to you should be at the top of your list as you examine and compare potential brokerages Whether you are thinking about changing brokerages today or in the future, your choice should be rooted in what is best for yourself and your career. Consider how the potential brokerage can make you happier as an agent and how it can give your clients the best customer experience. Moving brokerages is a business decision and should be treated as such

Be rational and critical when thinking about this change. Do what you know is best for you and don’t let outside opinions affect your decision. Take your time and remember to ask the questions you need about the things most important to you. By keeping in mind what motivates you and the factors driving your need for change, you’ll be sure to find the right brokerage to call home for the long term.To get started on getting your real estate license click here

Love,

Kartik

|

At its core, commercial real estate is exactly what it sounds like - any property that is owned exclusively to produce an income. When people hear the term, they usually call to mind images of office buildings Read more...

At its core, commercial real estate is exactly what it sounds like - any property that is owned exclusively to produce an income. When people hear the term, they usually call to mind images of office buildings and similar structures. But really, commercial real estate can include any type of property - and even just the land itself - which has the potential to generate a return on investment on behalf of the person who owns it.

Just a few examples of this include the aforementioned office buildings, retail spaces, industrial facilities, medical and hospitality properties and any other commercial space that can be leased for the express use of the business in question. All told, commercial real estate brings with it a wide range of different benefits for investors - all of which are worth exploring.

By far, one of the biggest advantages of commercial real estate for investors comes by way of the significant cash flow opportunities these properties often bring with them. Once you purchase a commercial property and begin to rent it to tenants, you start to generate a reliable stream of rental income. You can use that money to pay down the original purchase of the property without putting out any of your own money. Not only that but once the property is paid off, that revenue becomes a largely passive form of income - particularly if you hire a third party to actually manage the day-to-day operations of it on your behalf.

If you're purchasing commercial real estate with an eye towards establishing a larger portfolio, you also get to enjoy the advantage of significant equity appreciation. As you build more and more equity in the property, its value naturally rises - allowing you to leverage it to continue to grow your own company without putting yourself in financial risk.

If this is something that you're planning on making a career out of, it also gives you an incredible amount of flexibility when the time comes that you want to retire. You can always choose to continue to own the properties to rely on that "passive" income as outlined above, or you can sell them and collect a significant amount of money to fund the lifestyle that you've always seen for yourself. The choice is yours - which is exactly why so many people do it in the first place.

Experts also agree that investing in commercial real estate is also a great way to fight off things like inflation. One recent report indicated that commercial real estate investments in the United States tend to have the highest correlation to inflation, especially when compared to other types of investments like stocks and bonds. As inflation increases, so does the price of commercial real estate - meaning that you're protecting the value of your money of the long-term, regardless of what is currently happening in the context of the larger economy.

Having said all of that, it's crucial to understand that nothing in this life is a guarantee and success in terms of commercial real estate is chief among them. No two markets operate in quite the same way, which is why you cannot assume there is a "one size fits all" approach to investing in this field properly. Before you enter the fold, you need to analyze the local market and understand current trends and progressions that may give you an indication of which investments are worth your time and which ones may not be quite as lucrative as they appear.

Likewise, long-term success with commercial real estate is always about creating as much value as possible. This means that especially during those early days, you're likely going to be taking a number of steps to improve the quality of the building to improve net operating income as a result. That means investing in more features and amenities for tenants. That means making improvements to the structure itself for the purposes of safety and desirability. The more value you can create, the more money you can generate by way of rent and lease prices.

It’s important to understand that commercial property is valued in a different way than residential property - meaning that you'll want to throw out what you think you know and learn how things really work. The income potential on a piece of commercial real estate like an office building is directly impacted by its usable square footage. With individual homes, that isn't the case. This is a big part of why investors start working with commercial properties in the first place - this different valuation simply opens the door for greater and longer cash flow over time.

For the best results, you need to create a strategy before you begin investing and stick to it as much as possible. Know what your limitations are - what you're comfortable doing and what you're not. Know where the hot properties are in the market and make an effort to understand the current market conditions and, most importantly, why they are the way they are. Know how much you can potentially make on an investment before you actually execute it. The more effort you put in at the start of this process, the greater your chances are at finding long-term success with this and other investments moving forward. To learn more about commercial real estate or a real estate school visit our website

Love,

Kartik

|

At its core, house flipping is a process in which a real estate investor purchases a particular home with the express intention of soon selling it for a profit. For a house to be considered a true "flip," Read more...

At its core, house flipping is a process in which a real estate investor purchases a particular home with the express intention of soon selling it for a profit. For a house to be considered a true "flip," it needs to be purchased with the idea of selling it quickly - usually to capitalize on certain trends in the market at large.

House flipping has become incredibly popular over the last several years, particularly due to the potential return on investment if executed properly. In 2017, for example, one study indicated that just 5.7% of all home sales fell into this category. Flash forward just a few years to 2020 and that number had already climbed to 7.5%.

It's a process that is especially prominent in a "hot" real estate market and in areas where home prices are on the rise. Another study indicated that in 2017, the average gross profit on a flip was over $66,000 - and this is after any investments needed to make improvements on properties before they could be sold. Pittsburgh, Philadelphia, Baltimore and Cleveland were among the most popular markets during that time. But as is true with all investments, one must proceed with a certain degree of caution in order to make sure the process goes as it should. A significant ROI is never a guarantee but by keeping a few key things in mind, you can improve your chances as much as possible.

By far, the most important thing to understand about house flipping is that you need to decide how much you can afford to spend on an investment property before you actually do so.

In other words, it's a bit like gambling - never spend more money than you can afford to lose if things don't quite go your way. Again, given the uncertainty of the market and considering that there are a lot of parts of this process that are outside your control, nothing is a guarantee. Something may seem like a sure bet, but it never is - and you don't want to leave yourself disappointed or financially stretched because of a lapse in judgement.

Along the same lines, you should always focus your investment property search on various types of distressed properties that are themselves in need of major fixes and repairs. This accomplishes a few important things at the same time. First, you can usually purchase these properties at a significantly reduced cost because they've been sitting on the market for longer periods of time. Likewise, families and people who plan on buying a home to actually live there rarely want to deal with the work required to get it to a habitable condition.

But more than that, the amount of money you do pour into the home by way of fixes and repairs will increase its value significantly - meaning that you'll be able to command a premium price once you're on the other side of this process.

For the best results, select a few properties in a particular area to analyze to decide on the most profitable opportunity for a beginner real estate investor. This step is crucial, as it gives you a "bird's eye view" of what is going on in a particular area and what the long-term potential is in that market. It also helps you gain a better understanding of the highs and lows of the process, which should allow you to gain more insight into where you should be focusing your efforts and which "opportunities" aren't nearly as lucrative as they may initially appear.

You can also start building relationships with other real estate investors in the local housing market - a good idea for a few different reasons. For starters, someone who has been involved in this process for longer than you have will almost always have insight and wisdom to provide so that you don't have to make certain mistakes "the hard way." They can give you tips and outline best practices that help you get the most out of house flipping.

Beyond that, there may also come a day when one of your contacts identifies a great opportunity that they themselves cannot take advantage of. Maybe they have too many houses on the market right now and they don't want to take the chance to stretch themselves too thin - but there's nothing stopping them from picking up the phone and informing you about what they've discovered.

In the end, it's important to follow the "70% Rule" in house flipping. Essentially, this means that you should never pay more than 70% of the "after repair" value of a property (minus the costs of the repairs necessary to renovate the home, of course). This will give you an idea of the maximum amount you should spend on a home to achieve the highest possible return on investment. By using this as a general rule of thumb, it will help ensure that you always emerge with a profit - which in and of itself has always been the biggest priority.

Overall, house flipping certainly isn't for everyone - it takes a significant amount of care and attention-to-detail to get right. But those who follow best practices like those outlined above can enjoy a great amount of success - particularly in a market like the one we're in right now. To learn more about how to become a real estate agent or to learn more about real estate success stories visit our website

Love,

Kartik

|

You can finally apply for your real estate license online! It’s easy to do and you can upload all documents on the website https://secure.dre.ca.gov/elicensing/

To get started, you’ll need to create Read more...

You can finally apply for your real estate license online! It’s easy to do and you can upload all documents on the website https://secure.dre.ca.gov/elicensing/

To get started, you’ll need to create an account through e-licensing. During the

online application process you can pause at anytime and return later to pick up

where you left off.

Choose from 4 different types of applications:

Sales exam only

Sales exam and license combo

Brokers exam only

Brokers exam and license combo

Keep in mind if you apply for the exam only, you will have to go back onto the

e-licensing site to apply for your license after you pass your test.

If the application type is a combo exam and license, there will be an area for youto enter the main office address of where you will hang your license. If you do not have a designated office yet, click on the checkbox “I do not have a main office address at this time. Please issue my license in a non-working status.”

You’ll need to provide your social security number, driver’s license and proof of education which are your real estate class certificates. If you have changed your name you’ll need to provide any name change documents you have. Acceptable documents would be a marriage certificate or court order. Save all your uploaded

forms as PDF then upload.

Online payment methods accepted are:

For Credit cards

Visa, Mastercard, Amex, & Discover

For Debit cards

Visa & Mastercard

At the bottom of the page, there are two buttons. Click the “Sign and Pay” button when you are ready to submit the application to DRE. If you are not ready to submit the application, click the “Sign Later” button to return to the home page.

To check the current application processing timeframes, there is a link below the existing online applications table, which has more information, or navigate

directly to http://www.dre.ca.gov/Licensees/CurrentTimeframes.html

If you need to get started on your real estate classes here's how

Love,

Kartik

|

Launching your career as a real estate agent is an exciting venture filled with opportunities. But along with it comes the responsibility of managing your finances, particularly understanding the nuances Read more...

Launching your career as a real estate agent is an exciting venture filled with opportunities. But along with it comes the responsibility of managing your finances, particularly understanding the nuances of tax deductions. I wanted to write an article designed to help you navigate the intricate world of real estate tax considerations, shedding light on essential aspects that could maximize your earnings. Let's dig in and untangle the complexities of taxation so that you can focus on what you do best - making successful real estate deals.

As you venture into your journey as a real estate agent, it's crucial to understand how your earnings and taxes are structured. As you know, your income will predominantly be based on commissions from property sales and leases. Since you're classified as an independent contractor, you'll receive IRS Form 1099 at the end of each tax year. This classification makes understanding tax write-offs an important aspect of your real estate business. To ensure this guide provides the most value, let's delve deeper into tax considerations that every Realtor needs to know.

Classifying Realtors for Tax Purposes

Real estate professionals operate under a brokerage, but unlike traditional employment, they aren't classified as W-2 employees. Realtors are self-employed individuals running their businesses within the framework of their affiliated brokerages. This means that you're in charge of paying your taxes every year, and it's really important to know about possible tax deductions to help you manage your money better.

Understanding Tax Deductions: An Important Step for Realtors

A tax advisor can provide detailed guidance on what expenses can and cannot be deducted. However, a basic understanding of potential deductions from the onset of your real estate career is beneficial. This awareness will help you keep detailed records of your expenditures, an essential practice should you ever face an IRS audit.

Ordinary expenses that a Realtor can deduct span various areas of their professional activities. For example, mileage tracking becomes necessary, given how much travel the typical real estate agent does.

Similarly, marketing materials can be written off to promote your real estate services or property listings—such as business cards, direct mail postcards, open house signs, flyers, staging, professional photography and signage. Given its broad requirements and applicability, the IRS advertising expense deduction is a valuable resource for Realtors.

Beginning Your Realtor Journey: Costs and Deductibility

Starting your career as a real estate agent involves various costs that you should be aware of. For example, agents focusing on residential sales must join the California Association of Realtors and the National Association of Realtors after obtaining your real estate license. These fees, while necessary, are business expenses that can be written off on your taxes.

Access to the MLS (Multiple Listing Service) database, a vital tool for any Realtor, and Supra E-Key lock system also require payment. Furthermore, your brokerage may levy a desk fee and other monthly dues. All these costs are integral to doing business and can be written off as business expenses on your tax return.

Working from Home: Deducting Home Office Expenses

In today's digital age, remote working has become commonplace, bringing home office expenses into focus. If you're operating your real estate business from home, you can write off a portion of home-related expenses. This might include a portion of your costs for phone, computer, internet, and a portion of utilities. The IRS provides clear guidelines on calculating these deductions, depending on the size of your home office and its dedicated use for your business.

Building Client Relationships: A Closer Look at Deducting Gifts and Meals

As a real estate agent, fostering strong relationships with your clients is at the heart of your business. Often, this involves offering stellar professional services and nurturing these relationships on a personal level. This can mean taking a client out for a meal or gifting them a token of appreciation upon the successful closing of a sale. Let's delve deeper into understanding the tax implications of these client relationship-building expenses.

The Art of Gifting in Real Estate

Gift-giving is an integral part of the real estate profession. It's not uncommon for Realtors to present clients with closing gifts as a token of appreciation for their business or as a warm gesture to celebrate their new home.

When it comes to the tax implications of such gifts, the IRS imposes a limit. Only the first $25 spent on gifts for each person each year can be deducted. While this may seem modest, it's essential to remember that this limit applies per person. If you're gifting something to a couple or a family, the amount can be multiplied by the number of individuals.

This deduction may appear minor, but these gift deductions can cumulatively reduce your taxable income as you expand your client base. It's important to note that the $25 limit does not include incidental costs like engraving, packaging, or mailing, so these can be deducted in addition to the gift cost.

Client Meals: A Recipe for Deductions

Taking your clients out for meals is another common practice among real estate agents. Whether it's a casual lunch to discuss listing options or a celebratory dinner after a successful deal, business meals are a part of the real estate profession. The tax code recognizes this, allowing Realtors to deduct 50% of the meal's cost as long as the meal is business-related.

The nature of the meal is important here. It needs to be directly related to the active conduct of your real estate business or associated with a substantial and bona fide ordinary and necessary business discussion. It's best practice to keep detailed records of these meals, including the business purpose and the individuals present.

Remember that while client meals offer a chance for a deduction, they also present an excellent opportunity for building deeper relationships with your clients. By understanding your client's preferences and tastes, you can tailor these experiences to create a lasting impression, reinforcing your reputation as a thoughtful and dedicated professional.

In summary, while client gifts and meals are excellent ways to strengthen your relationship with clients, they also offer tax benefits. You must track these expenses diligently and work with a tax professional to maximize these deductions effectively. As a real estate agent, these relationship-building activities are an investment in your clients and a strategic move for your business's financial health.

Expanding Your Business: Don't Overlook Commission Deductions

As your real estate business grows and flourishes, you may pay commissions to other agents or employees who work with or under you. These commissions are an ordinary expense often overlooked but can offer substantial deductions. It's important to keep detailed records of these payments as they can quickly accumulate and provide significant tax relief.

Your Guide to Maximizing Deductions

It must be directly related to your real estate business to qualify as a deductible expense. As a real estate professional, it's crucial to consult with a tax advisor and refer to IRS Publication 535 for a detailed list of potential deductions. Meticulous record-keeping, staying updated with tax laws, and clearly understanding eligible write-offs are your keys to maximizing your tax deductions.

Navigating the complexities of tax deductions may seem daunting initially, but with the proper knowledge and planning, you can confidently manage your real estate business's financial aspect. Don’t forget to consult with your tax advisors to make sure you are applying these rules properly.

Are you embarking on a career in real estate? Remember to check out our interactive quiz to learn more about what this exciting and rewarding career offers!

Love,

Kartik

|

Homeownership is an essential part of the American Dream. Most people that are seeking to own a home turn to buying an existing home. It might not be exactly what you want, but you can see and feel it. Read more...

Homeownership is an essential part of the American Dream. Most people that are seeking to own a home turn to buying an existing home. It might not be exactly what you want, but you can see and feel it. You also have the option of building your own home. Let’s compare buying a home versus building a home.

Buying an Existing Home

Shopping for a new home can be fun and exciting as you plot the next journey in your life, but it can also be stressful. In tight markets, you must plan on bidding wars and making quick decisions. Getting pre-approved by a bank will tell you what you can afford and the type of home you can buy.

When you buy an existing home, you see exactly what you are getting. You can envision what the house will look like when you move in. Sure, you need to look past the wallpaper or outdated light fixtures, but those are cosmetic changes you can replace on your own time schedule.

After you find the house you like and agree on a price, you can expect the time it takes to close on your home to be from 30 to 60 days, depending on your bank’s mortgage approval process and the legal process in your state.

Be aware of the competition for the home you want. The better homes will sell fast, often within days of being listed for sale. If you want a move-in ready home, you need to have your paperwork in order and be ready to make an offer.

Building a Home

If the town you want to move to doesn’t have the type of home you are looking for, or you just want to build that perfect new home, then building a home is an exciting alternative. You will need to shop for a buildable lot and deal with zoning regulations, permits and contractors.

Building your own home can be an exciting process. You get to make all of those important decisions like designing the floorplan and selecting energy-efficient appliances. A good architect will guide you through the process.

This process takes time, often more than a year, from the time you purchase a lot to the time you can move in. In addition to obtaining a construction loan, you will need to obtain permits, attend hearings, hire contractors, and oversee the entire process.

It can be a challenge to build your home. You may need to deal with purchasing mistakes, poor materials, construction errors and even environmental factors like bad weather. Home construction projects often run over budget.

When deciding between buying a home or building a home, no matter what direction you take, you should obtain the advice of a licensed real estate professional who can guide you through the entire process from start to finish.To get your own real estate license start here - To take our quiz Should I become a real estate agent?

Love,

Kartik

|

Buying a home is a huge commitment – arguably, one of the biggest commitments you'll make in a lifetime. Because of this, the buying process can’t be taken lightly. Homeownership comes with many new Read more...

Buying a home is a huge commitment – arguably, one of the biggest commitments you'll make in a lifetime. Because of this, the buying process can’t be taken lightly. Homeownership comes with many new responsibilities, and finding the perfect property takes both patience and due diligence. However, if done correctly, owning a home can be both financially and personally rewarding.

Whether you’re buying your first home or your “forever” home, it’s incredibly easy to fall in love with a certain property and overlook vital details. If you’re ready to take the leap, you need to ask some key questions before buying a home.

The logical place to start in any home search is determining your budget. If you don’t consider how much you can afford independently of a mortgage company, you run the risk of taking on the maximum loan you’re approved for – whether you can actually afford that payment or not. In general, it’s smart to keep your monthly payment at or below 25 percent of your take-home pay.

While many prospective buyers are under the assumption a 20-percent down payment is required to buy a home, this is simply not the case. In fact, the average first-time buyer puts just six percent down, and certain loans require as little as zero. The right down payment for you depends on your financial situation, savings and goals. However, if you can afford it, a 20-percent down payment allows you to avoid paying for private mortgage insurance (PMI).

The down payment isn’t the only cash you’ll be spending on closing day. You’ll most likely also be responsible for closing costs, which can range from between two and five percent of your home’s purchase price. Your lender will provide you with a complete breakdown of the costs before closing day.

Keep in mind, the longer a home has been on the market, the more motivated a seller might be to make a deal. This means you may have more flexibility in the initial offer, terms, credits Keep in mind, the longer a home has been on the market, the more motivated a seller might be to make a deal. This means you may have more flexibility in the initial offer, terms, credits and more. While many homes sit on the market simply because the original listing price was too high, there are some cases where there is something drastically wrong with the home. Either way, a thorough inspection is important.

Always do your research regarding the local real estate market and recent sales in the neighborhood to help you determine if the asking price for the home you want is reasonable. This data can help you negotiate a lower offer or certain concessions, such as closing costs.

The quality of a neighborhood is one of the main reasons people choose to buy a certain home. It will also affect your ability to sell the home in the future. Because of this, it’s extremely important to research things like safety, convenience, schools and more.

Understanding a seller’s motivations for moving can give you more room for negotiation. A good buyer’s agent should be able to figure this information out and gauge how flexible the seller might be. For example, a seller relocating to a new state for a job will most likely be more motivated to negotiate than a seller simply exploring the market.

Do some research into the property’s history of insurance claims because it may affect your ability to get homeowners insurance and/or the price you’ll pay for insurance coverage. Because of this, it’s important to ask the seller for the full history of insurance claims.

Avoid taking on debt for furniture and decorations. Use what you already have, buy used and take it one room at a time. Many first-time buyers feel the need to take on another loan or more credit card debt to furnish their new place. It’s not always necessary!

Buying a home is a huge financial investment, and it is your responsibility to put in the necessary time and effort when researching potential properties. Asking the right questions and being fully prepared about the home buying process before placing an offer can save you both money and headaches down the road.

Love,

Kartik

|

Over the past year as more people have been working from home, many people are realizing their home needs are also changing. Working from home is on the rise so now is the time to reevaluate your changing Read more...

Over the past year as more people have been working from home, many people are realizing their home needs are also changing. Working from home is on the rise so now is the time to reevaluate your changing real estate needs to find the home that works best for you.

Working from Home Gives You Options and Flexibility

You may have found that working from home gives you options you didn’t have before. A majority of the workforce doesn’t need to be tied down to one specific area to do their job. These workers now have more flexibility and can pretty much live wherever they want. This means these workers can now move to a lower cost of living area or the location they have always dreamed of. You may be able to find a home in a more affordable area and get more house for your dollar. You’ll start to enjoy new benefits such as having more space and a dedicated home office. With the requirement of commuting gone, remote workers can now live in an area where they have always dreamed of vacationing, whether this is the mountains or near the beach. Relocating to a highly desired area also means you can live in an area that gives you better amenities, whether it’s the community or weather. Without a specific location for the job, the options are practically endless, and you can find your ideal spot. More people are moving away from the big cities and work centers, such as Los Angeles, Miami, Boston, New York, and San Francisco, entirely in favor of suburbs and more relaxed living. People may choose to go to communities that have a better quality of life but fewer job opportunities since they no longer must live where job opportunities are.

Flexibility Even for Part-Time Remote Workers

Some employees are now going back to the office part time, but this doesn’t mean that all flexibility is lost. Relocating within the region that gives you a better location but is a bit further away from the office can still be a good choice. You may have a longer commute, but you won’t be going into the office every day.The longer commute could be worth it to have a home with more comforts,space, or features. If you are going to be working from home, then finding a home that better suits your needs can be a priority.

Having a Home Office

Whether you are home part time or full time, having a home office is a necessity.Working from home has people recreating rooms in their homes to be used as office space. Some are looking to sell and buy homes with offices already in their new homes. Most people are seeing this as an opportunity to get the house they have always wanted so you can work comfortably from your home and still have a work life balance.

Love,

Kartik

|