What Are HOA Fees?

Homeowners Association fees are regular payments made by every property owner in a condominium or townhome community. They help cover shared expenses like maintenance, insurance, Read more...

What Are HOA Fees?

Homeowners Association fees are regular payments made by every property owner in a condominium or townhome community. They help cover shared expenses like maintenance, insurance, and the amenities you enjoy, ensuring everyone contributes their fair share. This shared responsibility keeps the property’s appearance, safety, and value consistent, benefiting all residents.

What Do HOA Fees Cover?

Most HOA fees focus on four main areas: maintenance, insurance, amenities, and reserve funds. Let’s break each one down further.

Maintenance

Landscaping: Caring for lawns, bushes, trees, and flowers to keep the community looking fresh and inviting.

Snow Removal: Clearing driveways, walkways, and parking areas during the winter to keep residents safe.

Common Area Cleaning and Repairs: Maintaining hallways, elevators, lobbies, and other shared spaces so everyone enjoys a clean, well-kept environment.

Insurance

A master insurance policy protects the building and common areas against fires, storms, or vandalism damage. While individual homeowners still need personal property insurance (often called an HO-6 policy) to cover belongings and the interior of their units, the HOA’s insurance takes care of the larger structure and shared grounds.

Amenities

Amenities vary, but your HOA fees might cover:

Pool Maintenance: Keeping the pool clean, safe, and ready for use.

Gym Maintenance: Ensuring exercise equipment is well-maintained for convenient, on-site workouts.

Clubhouse Maintenance: Preserving shared gathering spaces for parties, meetings, or community events.

These perks can increase your quality of life and enhance your property’s resale value.

Reserve Funds

A portion of your monthly fee goes into a reserve fund, which acts like a community savings account. It’s used for capital improvements and major repairs, such as replacing the roof or repaving the parking lot. By saving over time, the HOA can handle these larger projects without surprising you with big, last-minute bills, providing financial stability and peace of mind.

How Are HOA Fees Calculated?

Your HOA board creates an operating budget each year. They often conduct a reserve study to predict future maintenance and repair needs, providing a sense of security and preparedness. The HOA ensures fair contributions by estimating the total annual costs and dividing them among all units.

As a homeowner, you have the right to access the HOA’s budget documents and reserve studies, often through the HOA management company’s website or an online portal. This transparency empowers you to understand how your fees are used and ensures community accountability.

High vs. Low HOA Fees: What’s the Difference?

While lower fees might initially seem appealing, it's important to consider the long-term implications. They can sometimes lead to limited maintenance, fewer amenities, and smaller reserve funds. Over time, this can cause deferred maintenance, which may lower your home’s resale value. By being aware of these potential outcomes, you can make an informed decision about your investment.

For instance, let's consider a community in Rancho Cucamonga with low HOA fees of $ 100 per month and a community in Newport Beach with high HOA fees of $ 500 per month.

Scenario A (Low HOA Fees): The fees are low, so the community provides only basic landscaping and minimal exterior upkeep. Amenities are scarce, and repairs are postponed due to limited funds. Over the years, the property’s appearance has suffered, which may reduce its overall value.

Scenario B (High HOA Fees): The fees are higher, enabling the community to maintain beautifully landscaped grounds, conduct regular exterior building maintenance, and offer luxurious amenities such as a resort-style pool and a state-of-the-art fitness center. With well-funded reserves, the HOA can handle significant repairs without issuing special assessments. This ensures that the property remains attractive and can even increase in value over time, providing a sense of security for your investment.When choosing a community, it's crucial to consider what you get in return for the fees. Sometimes, paying more each month means fewer surprises and a more enjoyable living experience. By understanding the role of HOA fees in shaping your living experience, you can make a decision that aligns with your lifestyle and preferences.

Understanding Special Assessments

While the regular budget and reserve funds are crucial, they may not always cover unexpected issues like severe storm damage or sudden major repairs. In such cases, the HOA might issue a special assessment, a one-time fee in addition to your regular dues. This can be seen as a proactive measure to protect your investment and ensure the community's well-being.

Before buying, ask about the community’s history of special assessments.

It’s important to find out how often they’ve occurred and why they were needed. Understanding this can give you insight into how well the HOA plans for the future and handles emergencies.

Why HOA Fees Matter

Property values, community upkeep, curb appeal, and resale value all benefit from a well-funded and well-managed HOA. By paying HOA fees, you actively contribute to keeping common areas attractive, ensuring repairs are done on time, and maintaining amenities that enhance your quality of life and your home’s value. Your fees are not just a financial obligation, but a direct investment in your community's improvement.

These fees aren’t just another bill but an investment in your community’s future. With substantial financial planning, the HOA can keep your property looking great, making it a place you’re proud to call home. By understanding and being part of this planning, you can feel more empowered and informed about your community's future.

HOA fees (condo fees or HOA dues) are essential to condo or townhome ownership, and your role in understanding them is crucial. They pay for upkeep, insurance, amenities, and future repairs that keep your property safe, comfortable, and visually appealing. By taking time to understand the HOA’s budget, reserve funds, and history of special assessments, you can make a well-informed decision, knowing that your input is valuable.

If you’re still exploring your housing options, remember there’s a difference between condos and apartments. Equipped with this knowledge, you can feel confident you’re making the right choice for your lifestyle, budget, and long-term investment.

Love,

Kartik

|

Searching for the perfect place to call home can feel overwhelming, especially when you’re faced with a choice between condos and apartments. Both can offer comfortable living spaces and attractive Read more...

Searching for the perfect place to call home can feel overwhelming, especially when you’re faced with a choice between condos and apartments. Both can offer comfortable living spaces and attractive amenities, but they provide very different experiences. By understanding how they differ in ownership, costs, responsibilities, and lifestyle, you can decide which option is the best fit for you.

Defining Condos and Apartments

An apartment is a unit you rent in a building owned by a landlord, who could be a company, investment group or even an individual. When you rent an apartment, you don’t own the property and must follow the landlord’s rules.

A condo is a unit you own within a larger building or community. You’re responsible for maintaining your individual unit, while you and the other owners share the upkeep and costs of common areas—like hallways, lobbies, and fitness centers—through a homeowners association (HOA). You are also subject to the rules of the HOA.

Regional Variations

Keep in mind that condos and apartments can vary depending on where you live. Different cities and states have their own rules and customs about tenant rights, condo associations, and typical amenities. Before you choose, do some research on local laws, common fees, and the general housing market in your area.

Ownership: The Core Difference

Apartments: You pay rent to live in a space you do not own. The landlord makes key decisions about maintenance, upgrades, and rules.

Condos: You own your unit and share common areas with other owners. You have more decision-making power through the HOA, but must also follow the HOA’s rules and pay fees.

Responsibilities: Who Takes Care of What?

Apartments: The landlord usually handles repairs and maintenance. If something breaks, you call them to fix it.

Condos: Condo owners are responsible for repairs inside their unit. If something breaks, it’s your job to hire someone to fix it. The HOA often maintains common areas, handles larger building issues, and pays for those with the monthly fees collected from owners.

Costs: Rent vs. Mortgage, Taxes, and Fees

Apartments: You pay monthly rent, which may increase when you renew your lease. You might also have extra charges for parking or pets.

Condos: Owning a condo often means paying a mortgage, property taxes, and monthly HOA fees. The fees paid to the HOA funds insurance for common areas, building maintenance, and amenities. Sometimes, if the building needs a major repair—like a new roof—owners may have to pay a special assessment fee in the event there aren’t adequate reserves to pay for the item.

Insurance Considerations

Apartments: Renters typically need renter’s insurance, which is usually low-cost and covers personal belongings.

Condos: Owners need a homeowners insurance policy (often called an HO-6 policy) for the inside of their unit. The HOA’s master policy may cover the building’s exterior and shared areas. It’s important to understand what the HOA’s insurance covers so you know what your responsibilities are.

Amenities and Management

Apartments: Amenities, such as pools or fitness centers, are managed by the landlord or property management company. Renters have little say in how these spaces are run.

Condos: Amenities are managed by the HOA, which is made up of owners. This gives you a voice in how the building is maintained but also makes you partly responsible for its upkeep and improvement.

Lifestyle Considerations and Condo Association Dynamics: Flexibility vs. Stability

Apartments: Renting offers flexibility. When your lease is up, you can move easily without having to sell anything. However, you don’t build equity, and rent can increase over time.

Condos: Owning a condo can provide more stability and the chance to build equity if the property’s value rises. Still, selling a condo takes more effort than ending a lease, and you must follow HOA rules. These rules are outlined in documents like bylaws and CC&Rs (Covenants, Conditions, and Restrictions), and they can affect things like whether you can have pets, how you decorate, and where you park. As an owner, you can attend HOA meetings and vote on important matters like repairs, fee changes, or updates to common areas.

A well-managed HOA can help preserve or even boost a condo’s value by keeping the building in good shape and maintaining a healthy financial reserve. On the other hand, a poorly run HOA can lead to neglected maintenance, higher fees, and conflicts among owners, which can hurt property values. This means that while there’s potential for your condo to appreciate over time, there’s also the risk of depreciation if the building isn’t managed well.

Making the Right Choice

When choosing between a condo and an apartment, consider:

Do you prefer flexibility, or are you looking for long-term stability and equity building?

Can you handle the costs of a mortgage, property taxes, and HOA fees?

Are you comfortable following HOA rules and taking part in building decisions?

How long do you plan to live in this home?

By weighing these factors and researching local conditions, you’ll be better prepared to pick the option that fits your lifestyle, budget, and future goals.

If you're unsure whether condo ownership is right for you, consider attending informational sessions or workshops offered by a local real estate school. They can provide valuable insights and help you make an informed decision.

|

As an agent, you spend much of your time analyzing sales data, advising clients, and networking to uncover hidden deals. You understand how every piece of a transaction impacts a buyer’s bottom line. Read more...

As an agent, you spend much of your time analyzing sales data, advising clients, and networking to uncover hidden deals. You understand how every piece of a transaction impacts a buyer’s bottom line. Yet many agents forget to leverage these advantages when purchasing their homes. By representing yourself, you tap into exclusive resources like the Multiple Listing Service (MLS), have the ability to apply your negotiation expertise directly, and even earn the buyer’s side of the commission. But you’ll also need to remain objective—sometimes easier said than done—and work closely with your brokerage to ensure a smooth process.

Unlocking the Power of the MLS

Your first major advantage as a real estate professional is your direct access to the MLS. Unlike public-facing sites, the MLS offers comprehensive, up-to-the minute information on available properties.

Exclusive and Pre-Market Listings: You can learn about “coming soon” properties and other MLS statuses that never appear on the popular real estate portals. This early access allows you to submit offers before a surge of interest.

Brokerage Variations: Some brokerages provide different commission splits to their sales staff when they buy their own home. Know your brokerage’s policies to get the most out of the system.

Real-Time Updates: The MLS refreshes listings more quickly than general real estate platforms. By staying on top of these updates, you can move fast in competitive markets and gain an edge over other buyers.

By using the MLS to its full potential, you can uncover properties the public doesn’t even know about—often leading to less competition and potentially better deals.

Working with Your Brokerage

Before you dive headfirst into self-representation, it’s wise to have a conversation with your broker. Establishing clear expectations and understanding all office policies upfront can prevent misunderstandings later.

Commission Splits: As mentioned, confirm your office's commission policy for self-representation. Some brokerages let you keep most (or all) of the buyer’s agent commission, while others require a standard split.

Broker Support: Make sure your broker fully supports your plan. An ally in the office can help you navigate administrative or compliance-related hurdles.

Legal and Ethical Guidelines: Even if you act as a buyer and agent, you must follow all licensing laws, ethical rules, and local regulations—Double-check before making an offer, double-check office guidelines regarding disclosures, escrow processes, and contracts.

Having these details worked out ahead of time can prevent potential conflicts down the road and ensure that you remain on good terms with your brokerage.

Market Mastery: Navigating Trends and Pricing

Your experience analyzing market trends, comparable sales, and property data is one of your most valuable assets. Applying this insight to your purchase can help you spot undervalued homes and avoid overpaying.

Neighborhood Patterns: You know which neighborhoods are up-and-coming or experiencing price reductions. Buying in a neighborhood on the rise can lead to increased equity over time.

Data-Driven Comparables: Rather than relying on general online estimates, you can analyze the exact sale prices of similar homes. This data helps you craft a competitive but fair offer.

Timing the Market: Knowing when to act can be crucial, but remember that perfectly timing the market is notoriously tricky. Focus on finding the right property for your needs and negotiating the best price within current market conditions.

You can minimize risks and maximize your potential gains by combining real-time data and local insight and focusing on long-term benefits.

The Art of the Deal: Negotiating Like a Pro

Negotiation is often deciding how much you save on a home. As a real estate agent, you negotiate daily—but it can feel different when it’s your own money on the line.

Set Clear Goals: Just as you would advise a client, define your must-haves and deal-breakers early. This clarity will guide your decisions and keep you from overextending yourself when emotions are high.

Maintain Objectivity: Even seasoned negotiators can become emotionally invested when purchasing their home. Try to apply the same detachment and professionalism you would use for a client.

Price Negotiation Strategies: If a property is overpriced or needs substantial updates, don’t hesitate to offer below asking—or request closing cost credits. Your market data and experience can back up these requests.

Contingency Clauses: Whether you include financing, inspection, or appraisal contingencies, you can protect your interests without making your offer unattractive to sellers.

Flexible Closing Terms: Offering a quick close or adjusting the closing date to the seller’s preference can give you leverage. Often, these terms are just as appealing as a higher purchase price.

By applying your negotiation expertise and staying level-headed, you can secure favorable terms that reflect your best interests.

Due Diligence and Risk Mitigation

A thorough approach to due diligence is crucial for avoiding costly surprises. Remember - you’re protecting yourself.

Comprehensive Inspections: Beyond a general home inspection, consider specialized inspections such as termite, roof, sewer, or plumbing, especially if you suspect any underlying issues.

Environmental Assessments: If the property is older or in an area with potential ecological risks, look into environmental reports or assessments to ensure you know exactly what you’re buying.

Title Reports and Disclosures: Carefully review the title report for liens or easements, and don’t gloss over seller disclosures. Past water damage or unpermitted work can affect property value and safety.

Legal Requirements: Your day-to-day experience with contracts means you know how small mistakes can lead to significant legal problems. Double-check every clause to ensure your interests are fully protected.

Appraisal Considerations: Collaborate with your lender (or use your market knowledge if you’re paying cash) to ensure the property’s value aligns with the agreed purchase price.

Putting in the extra effort now can save you from expensive repairs or legal disputes after the deal closes.

Financial Benefits: Quantifying Your Savings

One of the most compelling reasons to represent yourself and earn your real estate license is the potential to keep a significant portion of the buyer’s agent commission.

Example: On a $600,000 home with a 3% buyer’s agent commission, that’s $18,000. Depending on your brokerage agreement, you might keep most—or all—of that amount.

Potential Uses for Savings: You could use these funds to make your down payment, cover closing costs, or invest in renovations.

A Caveat: Actual savings will depend on your brokerage policies and the specifics of the transaction. However, the financial benefits of self-representation are often substantial—and can provide a powerful boost to your overall home investment.

This extra capital can lower your monthly mortgage, bolster your equity position, and offer more options for future investments.

Maximizing the Advantage: Self-Representation Done Right

So, how can you ensure you get the most out of representing yourself?

Streamlined Communication: Because you’re both the buyer and the agent, you eliminate potential miscommunication about your needs and decisions.

Tailored Strategies: Every action you take—from market research to negotiations—directly supports your personal goals, allowing for a seamless, customized approach.

Efficient Process: You already know how to coordinate inspections, work with lenders, and manage paperwork, saving time and reducing stress.

Balancing Emotion and Expertise: Recognize that buying a home can be as emotional for an agent as it is for a client. Rely on your professional discipline to keep negotiations on track.

By merging your personal needs with your professional skill set, you can transform a typical real estate transaction into a highly strategic move.

As a real estate agent, you possess invaluable knowledge about listings, market trends, and negotiation tactics. By representing yourself, you can leverage all those strengths to find your dream home before it hits the market—potentially saving thousands of dollars. Be sure to have an open discussion with your broker, maintain objectivity, and follow through with thorough due diligence. With these steps, you’ll be well on turning your professional expertise into a significant personal advantage.

TLDR:

Don’t leave money on the table. Leverage your expertise, represent yourself, and find the perfect home while maximizing your savings.

Want to learn more about getting your real estate license and being able to represent yourself? Visit www.adhischools.com to get started.

Love,

Kartik

|

California Title Insurance: Protect Against Hidden Encumbrances

Have you ever heard a story about someone purchasing a home only to discover later that someone else claimed partial ownership or that Read more...

California Title Insurance: Protect Against Hidden Encumbrances

Have you ever heard a story about someone purchasing a home only to discover later that someone else claimed partial ownership or that an unpaid lien remained attached to the property? Issues like these can turn a dream home into a financial nightmare.

A property can have various ‘burdens’ on its title and while California law requires sellers to disclose known encumbrances, unforeseen issues can still surface. That’s where title insurance comes in. This article explains what title insurance is, what it covers, how it works, and why it’s so crucial for homebuyers in California.

What is Title Insurance?

Title insurance is a specialized insurance policy designed to protect your ownership rights and financial investment in real estate. Unlike homeowners’ insurance, which covers future events like fire or theft, title insurance safeguards you against past events that might affect the validity of your property’s title.There are two main types of title insurance policies:

Owner’s Policy: This policy protects the buyer’s interest in the property. It covers you up to the purchase price, shielding you from potential legal costs or financial losses if any undiscovered issues arise.

Lender’s Policy: Almost always required by lenders, this policy protects the mortgage company’s interest (usually up to the loan amount). If you finance your home with a mortgage, your lender will insist on a lender’s policy to ensure its investment is protected.

What Does Title Insurance Cover?

Title insurance shields you from problems that could emerge from previous owners or mistakes in the public record. Below are five common scenarios (out of many) that title insurance might cover:

Undisclosed Encumbrances: Sometimes, encumbrances such as easements or liens don’t appear in the initial public record search. For example, an easement that wasn’t properly recorded could give third-party rights to your property. Additionally, unpaid property taxes, mechanic’s liens (filed by contractors or builders for unpaid work), judgment liens, or even unrecorded mortgages may exist without your knowledge.

Errors in Public Records: Even minor clerical errors in deeds or misindexed documents can create significant complications. Mistakes like a misspelled name or wrong property description could lead to ownership disputes.

Fraud and Forgery: Unfortunately, identity theft and document forgery are realities in real estate. A past owner’s signature might have been forged on a deed or other legal document. Title insurance covers financial losses you could incur if you must defend your ownership against fraudulent claims.

Claims from Heirs: In some cases, a property might have been passed down through inheritance, and an undisclosed heir could appear, claiming rightful ownership or interest in the property. Title insurance protects you from these unexpected claims.

Boundary Disputes: Encroachments, as we learned, are a type of encumbrance. They arise when a fence, shed, or other structure crosses a boundary line. If a past survey was inaccurate or if a structure was built in the wrong place, you could face legal or financial consequences.

Real-World Example:

Imagine buying a home, moving in, and then receiving a notice stating that a builder had never been paid for renovations done by the prior owner. This builder filed a mechanic’s lien, which went unnoticed. Title insurance would pay off or resolve this lien, sparing you a significant financial burden.

The Title Search and Commitment

Before issuing a title insurance policy, the title company thoroughly examines county records, court filings, and other public documents to uncover any problems or “clouds” on the title. This extensive research helps identify mortgages, liens, easements, or other encumbrances that might affect ownership.

Once the search is complete, the title company issues a “title commitment” or “preliminary report.” This document details all the findings and lists any “exceptions” that the policy will not cover. Standard exceptions might include existing easements or restrictions on the property. It’s crucial for buyers (and their real estate agents or attorneys) to carefully review the title commitment before finalizing the purchase. If any red flags appear, you can address them or negotiate with the seller before closing.

How Much Does Title Insurance Cost?

Title insurance is typically a one-time premium paid at the real estate transaction's closing. In California, the cost varies based on the home’s purchase price and the county. It’s customary in many parts of California for the seller to pay for the owner’s policy, but this is negotiable.

Why is Title Insurance Important?

Financial Protection: Title insurance can save you from hefty legal fees or financial losses if a hidden title defect surfaces.

Peace of Mind: Knowing your ownership is shielded from past claims helps you focus on enjoying your new home.

Facilitates Future Transactions: A clear and insured title makes it easier to sell or refinance. Prospective buyers or lenders feel more comfortable knowing your property’s title is clean.

Legal Defense: Many title insurance policies cover the costs of defending against lawsuits challenging your ownership. In short, title insurance protects your wallet and your peace of mind.

Title insurance is crucial in the California home-buying process, ensuring that hidden encumbrances or past errors won’t jeopardize your investment. Discuss coverage details with your real estate agent, lender, or attorney for the best protection—putting into practice what you learned in real estate school.

Love,

Kartik

|

Are your clients tired of endless open houses and outdated listings? The truth is, many of them are already using technology to transform the home-buying process—and you can too.

Read more...

Are your clients tired of endless open houses and outdated listings? The truth is, many of them are already using technology to transform the home-buying process—and you can too.

As you know from our online real estate school, technology is transforming every stage of the real estate process, especially how we buy and sell homes.

From detailed online listings to immersive virtual tours, modern tools empower buyers to find their dream home faster and smarter than ever before. For real estate professionals, understanding these technologies is key to building trust, anticipating client needs, and staying competitive in today’s market.

This guide will not only explore the top real estate tools your clients are using but also show you how to incorporate them into your process to provide exceptional service and close deals efficiently.

Top Tech Tools Your Clients Are Using

Real Estate Portals: Your Clients’ First Stop

For most buyers, platforms like Zillow and Realtor.com are the starting point for their home search. These tools allow clients to browse listings, compare prices, and gather data before they even contact an agent.

Here’s what sets them apart:

Zillow: A popular choice for its user-friendly interface and "Zestimate" home value tool.

Realtor.com: Known for its accurate listings sourced directly from MLS databases.

How to Use This Insight:

As a professional, you’ll often need to address questions or misconceptions clients bring from these platforms. Be prepared to explain discrepancies between a "Zestimate" and actual market value or provide deeper insights into MLS listings they’ve already seen.

Must-Have Mobile Apps

Your clients aren’t just using websites—they’re taking their home search on the go with apps like those from Zillow or Realtor.com as examples. These apps offer:

Instant Alerts: Notifications for new listings help buyers act quickly in competitive markets.

GPS-Enabled Searches: Clients can explore homes near their current location during a neighborhood drive.

Seamless Syncing: Apps sync with web accounts, ensuring buyers can access saved searches anytime.

How to Use This Insight:

Encourage your clients to share their saved searches and alerts with you so you can align your efforts with their priorities. Download these apps yourself to stay in sync and respond quickly when clients flag potential properties.

Virtual Tours & 3D Walkthroughs

Virtual tours are becoming the new standard for clients who want to narrow their options before scheduling in-person visits. Tools like Matterport and Zillow’s 3D tours allow buyers to:

View layouts and finishes from the comfort of their home.

Visualize potential renovations or furniture placements.

Save time by eliminating homes that don’t meet their needs.

How to Use This Insight:

Consider investing in 3D walkthroughs for your own listings to meet client expectations. Use virtual tours as a discussion point, guiding clients to evaluate layouts and features they might overlook in photos.

Smart Search Strategies to Match Your Clients

Technology isn’t just about tools—it’s about using them effectively. Here’s how to leverage the strategies your clients are already employing:

Refine with Filters

Clients often use advanced search filters to narrow their focus:

Price range

Number of bedrooms and bathrooms

Amenities like pools, garages, or outdoor spaces

How to Use This Insight:

Help clients refine their search by advising them on realistic filters. For instance, suggest widening their price range slightly to account for negotiation opportunities.

Map-Based Searches

Proximity to schools, grocery stores, and public transit

Neighborhood amenities like parks or restaurants

How to Use This Insight:

Use the same maps your clients are exploring to highlight key features of a neighborhood. Show them how a home’s location aligns with their priorities, whether it’s a quick commute or walkable amenities.

Alerts and notifications

Buyers often rely on notifications to stay ahead in the market:

New listing alerts

Price change updates

How to Use This Insight:

Set up alerts on behalf of your clients to demonstrate your proactive approach. By monitoring updates in real-time, you can flag opportunities before they even ask.

Beyond the Listings

Buyers are no longer just shopping for a house—they’re evaluating neighborhoods, schools, and financial feasibility. Here’s how you can support their broader research:

Neighborhood Insights

Tools like Niche.com, GreatSchools.org and even Walk Score help clients assess community fit. They’re looking at everything from school ratings to crime data and walkability.

How to Use This Insight:

Position yourself as a local expert by complementing this data with your knowledge of the area. Offer personalized recommendations that validate or enhance the information clients find online.

Financial Tools

Clients are coming to the table armed with data from mortgage calculators, pre-approval tools, and budgeting apps.

How to Use This Insight:

Help clients interpret these tools by discussing factors like down payments, closing costs, or loan types. Your guidance can fill in gaps and build confidence in their decisions.

Your clients are already leveraging technology to streamline their home search—are you ready to meet them there? By understanding the tools they use and integrating them into your process, you can strengthen relationships, anticipate client needs, and provide an elevated level of service.

Love,

Kartik

|

The Impact of School Districts on Home Values

In the affluent town of Palo Alto, California, known for its top-ranked public schools and proximity to Silicon Valley, the median home price soars Read more...

The Impact of School Districts on Home Values

In the affluent town of Palo Alto, California, known for its top-ranked public schools and proximity to Silicon Valley, the median home price soars to over $3.5 million—nearly five times the state average. This stark contrast underscores a broader phenomenon: the undeniable link between school district quality and home values. For families with school-age children, the appeal of excellent schools often outweighs other considerations when choosing where to live. However, while strong school districts drive up property values and attract investment, underperforming schools can have the opposite effect, contributing to economic challenges and diminished community appeal.

Buyers will inevitably ask our real estate school graduates, 'How are the schools?' To address this, we should examine the complex relationship between school district quality and home values, exploring the factors that contribute to this connection and its implications for homeowners, buyers, and communities. But this is not just a matter of economics; it has profound social implications that cannot be ignored.

Factors That Influence Home Values in Strong School Districts

The connection between school district quality and home values stems from a variety of factors:

Academic Performance: Metrics like test scores, graduation rates, and college acceptance rates are often key indicators of school quality. Neighborhoods with high-performing schools consistently command higher home prices as parents prioritize academic outcomes for their children.

School Reputation and Rankings: Perception matters. Well-ranked schools in national and state evaluations tend to attract more homebuyers, even if those rankings only partially capture the school's actual quality.

Educational Programs and Resources: Specialized programs such as STEM initiatives, arts education, and robust extracurricular activities can significantly enhance a school’s appeal, boosting the desirability of homes in the area.

Teacher Quality: A strong teaching staff, characterized by experience, qualifications, and low turnover rates, is another major draw for families, adding to the prestige and performance of a school district.

School quality significantly shapes local economies by driving home values and influencing overall housing market trends.

The Economic Impact

Property Taxes: School districts are largely funded by local property taxes, creating a feedback loop where desirable districts see rising home values, which in turn generate more funding for schools. This cycle perpetuates disparities between affluent and less affluent areas.

Demand and Supply: Top-rated school districts often face high demand for limited housing stock. This scarcity drives prices upward, creating a competitive housing market where families are willing to pay a premium.

Return on Investment: Homes in desirable school districts typically retain or increase in value over time, making them a smart long-term investment. Even for buyers without children, the resale value of such homes remains a compelling incentive.

Affordability and Gentrification: Rising property values in sought-after districts can price out lower-income families, potentially leading to gentrification and displacement. This dynamic raises questions about equity and access to high-quality education.

Social and Community Impacts

The economic dynamics of strong school districts—such as increased property taxes and competitive housing markets—extend beyond finances, shaping the very fabric of local communities. These economic trends inevitably influence social structures and community engagement, revealing deeper implications for residents and neighborhoods.

Demographics: The quality of a school district often influences the socioeconomic and other demographics of a community. Affluent families are more likely to move into areas with strong schools, potentially exacerbating segregation.

Community Involvement: Strong schools foster a sense of community pride and engagement. Parents are more likely to participate in school activities, local governance, and volunteer efforts, further strengthening the neighborhood.

Amenities and Development: The presence of high-performing schools attracts additional investments in community amenities like parks, libraries, and local businesses, which further enhance property values.

Socioeconomic Disparities: The cycle of affluent communities benefiting from better-funded schools while less affluent areas struggle highlights a critical equity issue. This disparity perpetuates systemic inequalities that can have long-term societal consequences.

Although the social and community benefits of strong school districts are significant, they are not without challenges. A closer look at these complexities highlights key nuances, such as equity issues and market fluctuations, which underscore the importance of a balanced and inclusive approach.

Considerations and Nuances

Beyond Test Scores: While test scores are often the most visible metric of a school’s success, factors like school safety, diversity, and climate are equally important for families and communities.

Hyperlocal Variations: Even within highly rated school districts, there can be significant variations in school quality, influenced by factors like school size, administration, and community support.

Market Fluctuations: Economic downturns and housing market volatility can affect property values in even the most desirable school districts, though these areas often recover more quickly.

Equity in School Funding: The reliance on property taxes to fund schools often perpetuates disparities, with wealthier areas enjoying better resources. Addressing this inequity is crucial for fostering more balanced opportunities.

Alternative Schooling Options: The availability of charter and private schools adds another layer of complexity to the relationship between school districts and home values. In areas with high-performing private or charter schools, families may prioritize access to these institutions over public schools, potentially reducing the pressure on housing demand within certain districts. Conversely, the presence of prestigious private schools can increase overall home values in a region, as families seek proximity to these institutions regardless of the quality of the local public schools. This dynamic illustrates how alternative schooling options can shape housing markets in unexpected ways.

The impact of school quality extends far beyond the classroom, shaping everything from local economies to social structures. But this influence comes with a price, raising concerns about housing affordability and equity.

To address these issues, policymakers should consider several specific actions:

Increase State and Federal Funding: Allocate more resources to schools in lower-income areas to reduce disparities in educational quality and resources.

Implement Property Tax Reforms: Explore alternative funding models, such as pooling property taxes across districts, to ensure a more equitable distribution of school funding.

Support Holistic Education Metrics: Encourage policies that evaluate schools beyond test scores, including factors like student engagement, safety, and extracurricular opportunities.

The connection between school district quality and home values is both powerful and complex. Strong schools benefit not just individual families but entire communities, boosting local economies and fostering a sense of well-being. However, this relationship also creates challenges, such as rising housing costs, widening inequalities, and systemic barriers that leave many behind.

For homebuyers and homeowners, understanding this connection is key to making decisions that align with their priorities. But the responsibility for addressing these deeper issues lies with policymakers. By tackling funding gaps, looking beyond test scores to evaluate schools, and exploring creative solutions, we can build a fairer system—one that ensures all families and communities have access to the benefits of excellent education.

Love,

Kartik

|

Buying a home is a significant milestone, and for most people, securing a mortgage is a crucial step in the process. Navigating real estate financing can seem daunting as interest rates fluctuate and housing Read more...

Buying a home is a significant milestone, and for most people, securing a mortgage is a crucial step in the process. Navigating real estate financing can seem daunting as interest rates fluctuate and housing markets grow more competitive. Understanding how to navigate the mortgage process is more important than ever, and it's essential to recognize that this journey can vary significantly based on location, economic conditions, and personal circumstances. This article provides essential home mortgage tips and insights to help you make informed decisions on your path to homeownership.

As a new real estate agent fresh out of real estate school, remember this vital principle: be your own best client. While this article is geared toward helping buyers navigate the complexities of qualifying for a mortgage, the advice within applies just as much to you as it does to them. The true path to wealth in real estate isn’t solely in the properties you sell but in the properties you acquire along the way. By investing in real estate, you secure your financial future and gain firsthand experience that will make you a more informed and credible advisor to your clients. Let every transaction remind you that the best investment you can make is in yourself.

Understanding Your Financial Readiness

Before diving into mortgage options, it's crucial to assess your financial readiness. This step is not just important, it's empowering. It involves:

Assessing Your Credit Score

Your credit score determines the interest rates and loan terms for which you qualify. A higher score generally translates to better terms.

To improve your credit score, pay bills on time, reduce credit card balances, and avoid opening new credit accounts unnecessarily.

For instance, a buyer with a credit score of 750 might secure a 5% interest rate, while a score of 650 could lead to a 6.5% rate—a difference that could cost tens of thousands over the life of a loan.

Evaluating Your Budget with the 28/36 Rule

The 28/36 rule is a helpful guideline that can provide you with a sense of direction. It suggests that up to 28% of your gross monthly income should go towards housing expenses, and your total debt should be at most 36% of your gross income.

Determine a comfortable down payment amount while considering other savings goals and expenses, such as emergency funds, retirement savings, and other financial commitments.

Exploring Mortgage Options

Once you have a good grasp of your finances, it's time to explore the different mortgage options available:

Types of Mortgages

Fixed-Rate Mortgages: Ideal for buyers who prefer predictable monthly payments and plan to stay in their homes long-term.

Adjustable-Rate Mortgages (ARMs): These have interest rates that adjust periodically, making them suitable for buyers who plan to move or refinance within a few years. I generally don’t recommend these.

Government-Backed Loans:

FHA loans: Great for first-time homebuyers with lower credit scores or limited down payments.

VA loans: Exclusively for veterans and eligible service members, offering competitive terms and no down payment.

USDA loans: Designed for rural properties, providing low or no down payment options for qualified buyers.

Interest Rates and Loan Terms

Economic conditions and your creditworthiness influence interest rates.

Use online mortgage calculators to compare the costs of a 15-year loan versus a 30-year loan.

For example, "Have you ever wondered how much that extra 0.5% interest rate could cost over 30 years? A quick calculation can show you the impact on your budget."

Preparing Your Mortgage Application

A well-prepared mortgage application can streamline the approval process.

Gathering Required Documents

Lenders typically require proof of income (pay stubs, tax returns), employment verification, credit history, and documentation of assets (bank statements, investment accounts).

Avoiding Common Pitfalls

Refrain from making major purchases or opening new lines of credit while your mortgage application is under review, as these actions can negatively impact your credit score and approval chances.

Finding the Right Lender

When it comes to finding the right lender, don't settle for the first one you come across. Take your time, do your research, and make a decision that you feel confident about.

Shop Around for the Best Rates

Compare interest rates, fees, and loan terms from various banks, credit unions, and mortgage brokers to find the most favorable offer.

Ask the Right Questions

Inquire about lender fees, interest rate lock options, prepayment penalties, and other concerns.

Making the Most of Pre-Approval

Getting pre-approved for a mortgage offers several advantages:

What Pre-Approval Means

A pre-approval indicates that a lender has reviewed your finances and will lend you a specific amount.

Strengthening Your Offer

In competitive real estate markets, being pre-approved demonstrates your seriousness as a buyer and can give you an edge over other offers.

Understanding Closing Costs

Be prepared for closing costs, including appraisal fees, title insurance, loan origination, and more.

Some lenders or sellers may offer to cover part of the closing costs. Feel free to negotiate or inquire about potential discounts.

Reviewing the Fine Print

Carefully review all loan documents before signing to ensure you understand the terms and conditions of your mortgage. This is crucial as it can help you avoid any surprises or misunderstandings later on. Pay close attention to the interest rate, loan term, prepayment penalties, and any other fees or conditions.

Tip: Carefully compare the final Closing Disclosure to your initial Loan Estimate to ensure all terms align as expected.

Securing a mortgage requires careful planning and informed decision-making. By understanding your financial readiness, exploring mortgage options, preparing a strong application, and finding the right lender, you can confidently navigate the process. Remember to get pre-approved, understand closing costs, and review loan documents thoroughly. These home mortgage tips empower you to make sound choices and achieve your homeownership dreams.

Love,

Kartik

|

Imagine waking up on a frigid winter morning to discover your heater has stopped working. Or picture a water heater that suddenly malfunctions around holiday time. Would you be ready to handle the cost Read more...

Imagine waking up on a frigid winter morning to discover your heater has stopped working. Or picture a water heater that suddenly malfunctions around holiday time. Would you be ready to handle the cost and hassle alone, or would a home warranty lift some of that burden?

Fresh out of real estate school, most new real estate agents typically start by working with buyers. As a buyer agent, being able to negotiate with sellers to cover the buyer's home warranty cost is crucial. This ensures protection for the buyer should any issues arise after the escrow closes.

I wanted to delve into home warranties and evaluate whether or not they truly offer peace of mind.

What is a Home Warranty?

A home warranty is a service contract that may cover the repair or replacement of major home systems like appliances, HVAC, plumbing, and electrical systems. Unlike home insurance, which protects against damage from unexpected events like fires or storms, a home warranty covers the normal wear and tear that daily use can inflict on a home.

The Benefits of Home Warranties

Peace of Mind: As new homeowner Sarah J. recounted, "Having a home warranty gave me such a profound sense of security. When my water heater broke, I didn't panic. I just called the warranty company, and they took care of everything." This level of reassurance is what a home warranty can offer.

Budgeting: Home warranties help you avoid unexpected and potentially expensive repair bills. You typically pay a service call fee, but the warranty company covers the rest within the limits of your contract.

Long-term Savings: Consider this: a new refrigerator costs $1,500, and a furnace replacement can easily exceed $5,000. With a home warranty costing around $500-$800 per year and service fees, you could save thousands over the long term. This could be a smart financial move for any homeowner.

Great for Older Homes: A home warranty can be especially beneficial if home warranty can be especially beneficial if you're buying an older home with aging appliances and mechanical and plumbing systems.

Ideal for First-time Homebuyers: New homeowners often need more experience to diagnose and handle home maintenance issues. A warranty simplifies the process by connecting you with qualified service providers.

Potential Downsides of Home Warranties

Coverage Denials: One of the biggest complaints about home warranties is the denial of claims, which can happen due to pre-existing conditions, lack of proper maintenance, or issues outside the contract's scope. Industry data suggests that as many as 20% of claims are denied initially, though some may be approved upon appeal.

Service Issues: Finding qualified technicians and scheduling timely repairs can sometimes be challenging.

Cost vs. Benefit: Weigh the warranty premium and service call fees against the potential repair costs. However, for many homeowners, the peace of mind and protection against catastrophic expenses outweigh these limitations.

How to Choose the Right Home Warranty

Compare Companies: Research different home warranty providers, comparing their coverage options, costs, and customer reviews.

Read the Fine Print: Carefully examine the contract, paying close attention to coverage limits, exclusions, and claim procedures.

Check Customer Reviews: Look for companies with a strong reputation for customer service and fair claim handling.

Ask the Right Questions: Don't hesitate to ask potential providers these key questions:

What is the average response time for service requests?

Are there any limits on the number of service calls I can make annually?

What are the common reasons for claim denials?

Can I choose my service technician?

Home warranties can offer valuable protection and peace of mind, especially for first-time homebuyers or those purchasing older homes. However, weighing the potential benefits against the costs and limitations is crucial. Choosing the proper warranty and understanding your contract thoroughly is key to a positive experience.

Love,

Kartik

|

Older homes whisper stories of the past, offering a unique sense of history and character that many find irresistible. The charm of original hardwood floors, intricate crown moldings, built-in cabinetry, Read more...

Older homes whisper stories of the past, offering a unique sense of history and character that many find irresistible. The charm of original hardwood floors, intricate crown moldings, built-in cabinetry, and stained glass windows are just a few examples of the architectural details that contribute to this character. However, the reality of owning an older home can present unexpected challenges. While those creaky floorboards might add to the charm, they could also signal underlying structural issues.

While there is no substitute for a physical inspection by a competent professional, I wanted to write an article on how to navigate some of the complexities of buying an older home to ensure your dream home becomes something other than a money pit. Because lots of our real estate school students dream of selling unique and historic homes it's important to keep in mind that it’s not just about the charm, it's also about being cautious and prepared.

Structural Integrity

Foundations: A solid foundation is crucial. Look for telltale signs like cracks, shifting, or evidence of water damage. Uneven floors, doors that stick, and cracks in the walls, particularly above windows and doors, can all point to foundation problems.

Cracks: Imagine the foundation as the base of a LEGO structure. If that base cracks or shifts, the LEGO bricks above will no longer fit together neatly. Cracks in walls, especially diagonal ones spreading from corners of windows or doors, show that the house's frame is being pulled out of shape by movement in the foundation below.

Uneven Floors: A sinking or uneven foundation can cause the floor joists above to sag or become misaligned. This leads to sloping or bouncy floors. Think of it like a table with uneven legs – it wobbles.

Sticking Doors: When a foundation shifts, it can distort the door frames. This makes doors difficult to open or close because they no longer fit squarely within the frame. It's like trying to fit a puzzle piece into the wrong spot.

Checklist:

Are the floors level?

Do doors and windows open and close smoothly?

Are there any visible cracks in the foundation walls?

Is there any evidence of water damage in the basement or crawlspace?

Roof: The roof is your first defense against the elements.

Checklist:

What is the age of the roof? (And what is the typical lifespan for that roofing material? - e.g., asphalt shingles typically last 20-30 years)

Are there any missing, damaged, or curled shingles?

Are there any signs of sagging or unevenness in the roofline?

Are there any signs of moss or algae growth? (This can indicate moisture problems.)

Are the gutters and downspouts in good condition? (Proper drainage is essential.)

Is there any evidence of water damage in the attic? (Look for stains, mold, or rot.)

Walls and Ceilings: Inspect walls and ceilings for cracks, water stains, or bowing. These imperfections could indicate structural issues, water damage, or poor maintenance.

Plumbing and Electrical Systems

Common Plumbing Problems in Older Homes

Plumbing: Older homes may have outdated plumbing systems, such as galvanized pipes, and be prone to corrosion and leaks. Inquire about the age of the plumbing and look for signs of leaks, low water pressure, or discolored water.

Checklist:

What type of plumbing pipes are used in the home?

What is the age of the plumbing system?

Are there any visible leaks or signs of water damage?

Is the water pressure adequate in all fixtures?

Electrical Safety Concerns

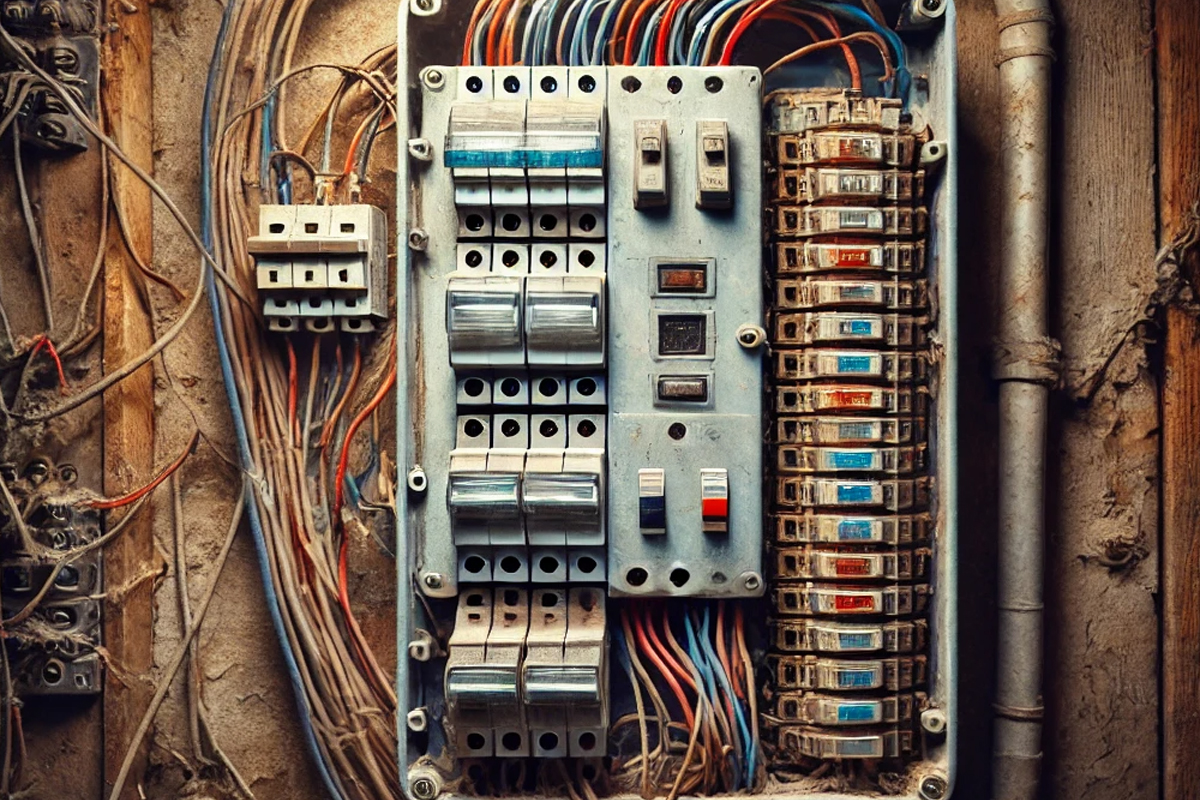

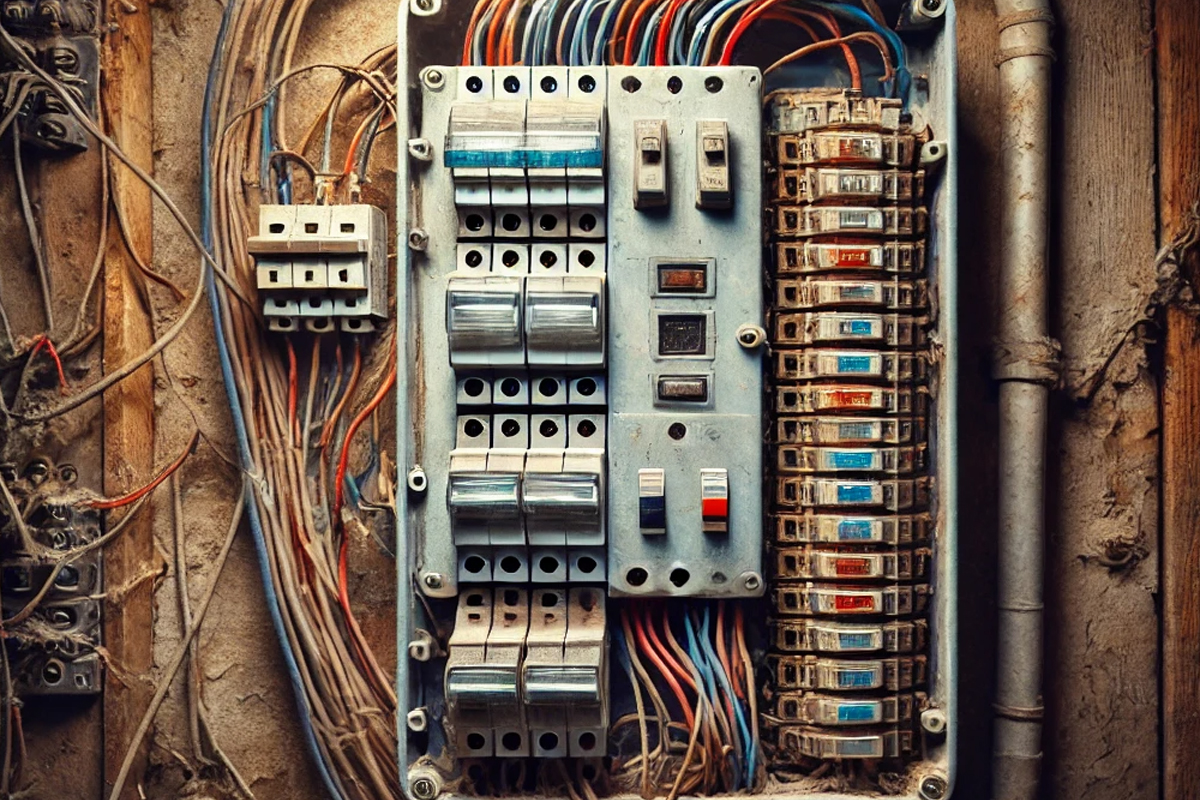

Electrical: An outdated electrical panel can be a safety hazard. Evaluate the panel for its capacity and age. Look for obsolete wiring (like knob-and-tube wiring), insufficient outlets, and any signs of electrical problems, such as flickering lights or frequent circuit breaker trips.

Knob and tube wiring is an old type of electrical wiring that was commonly used in homes from the late 1800s to the early 1900s. You can recognize it by its white ceramic knobs and tubes, which help hold and protect the wires.

The knobs are used to keep the wires attached to the wooden beams in the house, while the tubes are used when the wires need to pass through those beams. The system doesn't have a ground wire, which is used in modern wiring to help protect against electrical shocks and fires.

Because it's so old, knob and tube wiring doesn't meet today's safety standards and can't handle the amount of electricity we use now with all of our gadgets and appliances. That's why it's usually replaced if found in homes today, to make sure everything is safe and works well with modern electricity needs.

Checklist:

What is the age of the electrical panel?

What is the amperage of the electrical service?

Are there any signs of outdated wiring?

Are there enough outlets and circuits to meet your needs?

Hazardous Materials

Asbestos: Asbestos was commonly used in insulation, flooring, and siding in older homes. If you suspect asbestos-containing materials, hire a qualified professional for testing and abatement. Recent regulations have focused on safer removal methods to minimize health risks.

Lead Paint: Homes built before 1978 may contain lead-based Paint, which can be hazardous, especially for children. Lead paint testing and proper reduction are crucial. Modern encapsulation methods offer compelling alternatives to complete removal in some cases.

Heating, Ventilation, and Air Conditioning (HVAC)

System Age: HVAC systems have a limited lifespan, typically 15-20 years. Determine the age of the system and consider its remaining years of service. Older systems are less efficient and more prone to breakdowns.

Efficiency: Pay attention to signs of inefficient operation, such as uneven heating or cooling, drafts, and high energy bills. Consider upgrading to a modern, high-efficiency system to save money and reduce environmental impact. Look for systems with high SEER (Seasonal Energy Efficiency Ratio) and AFUE (Annual Fuel Utilization Efficiency) ratings.

Insulation and Energy Efficiency

Insulation Quality:

Inspect the attic, walls, and basement for adequate insulation.

Look for sufficient insulation depth (e.g., at least 12 inches in the attic) and check for any signs of moisture or pests.

Consider the type of insulation (e.g., fiberglass batts, blown-in cellulose) and its R-value, which indicates its thermal resistance. The higher the R-value, the more effective the insulation.

Poor insulation leads to higher energy bills and uncomfortable living conditions.

Windows and Doors: Check for drafts around windows and doors. Single-pane windows are notorious for heat loss. Consider upgrading to energy-efficient windows and doors to improve comfort and reduce energy consumption.

Potential for Renovations and Upgrades

Local Regulations: Research local zoning laws and building codes, especially if the home has historical status, as renovations might be restricted or require special permits.

Costs vs. Value: Get estimates for any necessary renovations and upgrades. Consider the potential return on investment and whether the improvements will significantly increase the home's value.

Financing Renovations: Explore financing options for renovations, such as home equity loans, personal loans, or government programs that offer incentives for energy-efficient upgrades.

Checking for Pest Infestations

Common Pests: Be vigilant for signs of termites (mud tubes, wood damage), rodents (droppings, gnaw marks), and other pests like carpenter ants (sawdust-like frass).

Signs of Infestation: Check for evidence of past pest control treatments. A history of infestations could indicate ongoing problems.

Water Damage and Mold

Signs of Damage: Look for water stains on ceilings, walls, and floors. Mold growth and musty odors are also red flags.

Sources of Water Damage: Inspect the roof, gutters, and drainage systems. Inquire about any history of flooding or leaks.

Legal and Insurance Issues

Property History: Research the property's history for past insurance claims, disclosures by the seller, and any known issues.

Insurance: Ensure that you can obtain homeowners insurance for the property. Older homes may present challenges or higher premiums due to age and potential risks.

Hiring a Professional Inspector

When hiring a home inspector, it's important to ask the right questions to ensure a thorough inspection. Here are some key questions to consider:

What is your experience with older homes?

What specific areas will you be inspecting?

Can you provide references from previous clients?

How long will the inspection take?

When will I receive the inspection report?

Choosing an Inspector: Select a qualified and experienced home inspector. Ask about their credentials, what they look for, and whether they have experience with older homes.

Understanding the Inspection Report: Carefully review the inspection report. Pay close attention to any significant issues and ask the inspector to explain any findings you need help understanding.

California specific pro-tip: In California, there is no state licensing requirement for home inspectors. This means that home inspectors in California are not regulated by any state agency, unlike in other states where inspectors must be licensed. As a result, the burden often falls on the consumer to ensure they are hiring a qualified and experienced inspector. It’s recommended to look for inspectors who are certified by reputable organizations, such as the American Society of Home Inspectors (ASHI) or the International Association of Certified Home Inspectors (InterNACHI), as these certifications typically require passing an exam, completing a certain number of inspections, and adhering to a strict code of ethics and standards of practice.

Common Problems by Era

Victorian Homes (pre-1900) are often characterized by knob-and-tube wiring, asbestos insulation, and foundation issues due to their age.

Mid-Century Homes (1950s-1960s): These homes may feature outdated plumbing, such as galvanized pipes, and are known for using aluminum wiring, which can pose a safety hazard.

Buying an older home can be a rewarding experience, but it's essential to approach the process with realistic expectations and a keen eye for potential problems. By conducting thorough inspections, consulting professionals, and addressing any issues proactively, you can minimize risks and enjoy the unique charm and character of your older home for years to come.

Love,

Kartik

|

The real estate industry is built on trust. Buying or selling a property is often the most significant financial decision in a person's life, and clients depend on their agents for expert guidance and Read more...

The real estate industry is built on trust. Buying or selling a property is often the most significant financial decision in a person's life, and clients depend on their agents for expert guidance and support. This reliance makes ethical conduct vital for every real estate professional. Ethical agents don't just follow the rules; they prioritize honesty, transparency, and their client's best interests in every interaction. This commitment to integrity builds strong client relationships and forms the bedrock of a successful and fulfilling career.

Understanding Your Role as a Fiduciary

Real estate agents hold a unique position of trust. They act as fiduciaries for their clients, meaning they have a legal and ethical obligation always to put their clients' needs first. This fiduciary duty encompasses several vital principles: loyalty, always prioritizing the client's interests; confidentiality, safeguarding sensitive information; disclosure, providing all relevant information, even if it's not favorable; obedience, following lawful client instructions; reasonable care and diligence, providing competent and skilled service; and accounting, handling funds and property responsibly.

Transparency: The Key to Building Trust

Open and honest communication is essential for building strong client relationships. Be upfront about potential challenges, market conditions, and any factors influencing their decisions.

Transparency goes beyond simply answering questions; it means proactively sharing information and setting realistic expectations. Communicate timelines, potential obstacles, and the intricacies of the real estate process. Keep your clients informed and engaged through regular updates and feedback, ensuring they feel heard and understood throughout their journey.

Example: The Power of Transparency in Real Estate

A seasoned real estate agent, Emma met with Alex and Mia, a young couple eager to purchase their first home. They were captivated by a charming, older house with a history of foundation issues. Understanding the importance of honesty, Emma openly shared her findings with the couple, explaining the potential for future complications and the competitive market conditions.

Determined to ensure their first investment was sound, Emma discussed the benefits and drawbacks of older versus newer homes, highlighting possible challenges and setting realistic expectations for the buying process. She maintained frequent communication, providing updates and addressing their concerns, which made them feel supported and valued.

Appreciating her candidness, Alex and Mia explored other listings and eventually purchased a newer home that offered stability without unforeseen costs. Grateful for Emma's guidance, they later expressed their happiness and confidence in their decision, thanking her for her transparency.

Emma's commitment to transparent, honest communication helped them find the right home and solidified a trusting client relationship, showcasing the critical role of transparency in real estate transactions.

Navigating Ethical Dilemmas

Even with the best intentions, real estate professionals often encounter ethical dilemmas. These situations require careful consideration and a commitment to upholding your fiduciary duties.

Dual Agency: Representing the buyer and seller in the same transaction presents unique challenges. Disclose this relationship clearly and obtain informed consent from both parties. Strive to maintain neutrality and ensure that both clients receive fair and equal representation.

Misrepresentation and Fraud Avoid any temptation to exaggerate or misrepresent facts. Providing false or misleading information can have severe legal and ethical consequences. Always prioritize honesty and accuracy in your dealings.

Confidentiality: Protecting client privacy is paramount. Handle sensitive information with discretion and use it only for the intended purpose. Avoid discussing client matters with unauthorized individuals.

Multiple Offers: When managing multiple offers, present all offers pretty and transparently to the seller. Avoid any actions that could give one buyer an unfair advantage and guide your client to make informed decisions based on their best interests.

The Importance of Ongoing Learning

Real estate is a dynamic field with ever-changing laws and regulations. Commit to continuing education to stay informed about the latest legal requirements, market trends, and best practices. This ongoing learning demonstrates your dedication to professionalism and enhances your ability to serve your clients effectively.

Ethics as a Competitive Advantage

Ethics can be a powerful differentiator in today's competitive real estate market. Clients are increasingly seeking agents they can trust, professionals who prioritize integrity over quick deals. By showcasing your commitment to ethical conduct, you attract clients who value these principles and build a loyal client base that fuels long-term success.

Building a Legacy of Integrity

Ethical conduct is not just a set of rules to follow; it's a way of doing business that reflects your values and commitment to your clients. By consistently acting with integrity, you build a reputation that attracts clients, earns referrals, and fosters lasting relationships. Embrace ethical practices in every aspect of your real estate business, and you'll achieve professional success and contribute to a more trustworthy and respected real estate industry.

Love,

Kartik

|