In California, a place famous for its sunshine, cool tech, and lively culture, there's a big problem — housing is really expensive. It's especially tough for people who want to pay off their homesand live without a mortgage. Recent data from 2023 shows that many people in California find it hard to reach this important money goal.

The State of Homeownership in California

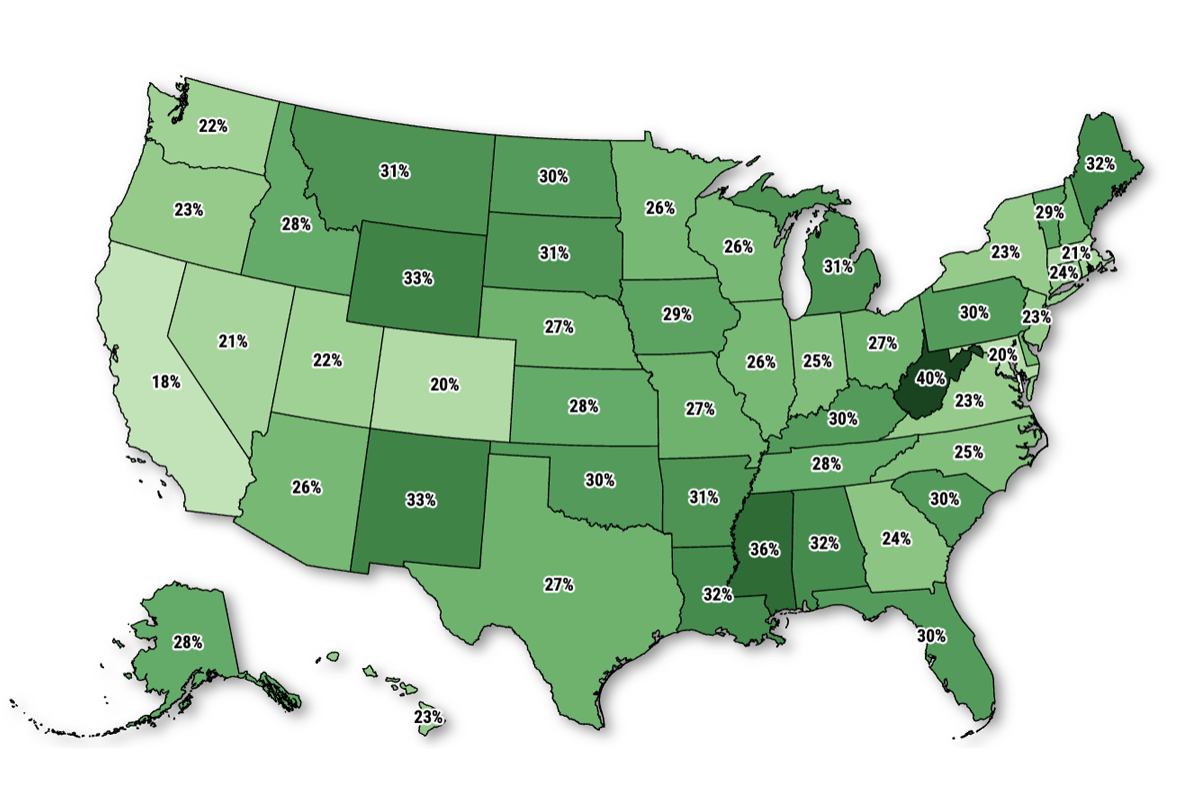

Many people in California dream of owning a home outright, but for most homeowners, it remains just a dream. Only 18% of homes in California are paid off with no mortgage. This is much lower than the national average of 26%. Looking around the country, Washington D.C. has an even lower rate of 10% of homes without a mortgage, while West Virginia is way higher at 40%. This shows a big difference in how people own homes without a mortgage in different parts of the United States.

Homeownership with Mortgages

In California, the vast majority of households own their homes with the help of a mortgage. This can be traced back to several key factors, primarily the high property prices across the state. In many California cities, real estate prices are significantly higher than the national average, which forces many residents to take on large mortgages that can take decades to pay off.

Economic pressures also play a crucial role in this scenario. The cost of living in California is among the highest in the country, which includes not just housing but also taxes, utilities, and general living expenses. This economic environment makes it challenging for many families to save enough money to buy a home without financial assistance. As a result, long-term mortgage plans become a necessary option for many Californians, binding them to years of debt as they work towards owning their home completely. This situation reflects a broader issue of accessibility and affordability in California's housing market, impacting how residents achieve financial stability and homeownership.

Renting in California

In California, a lot of people rent their homes instead of owning them. About 43% of households in California are rentals, which is the third highest rate in the whole country. Only Washington D.C., where 60% of homes are rented, and New York, with 45%, have higher rates. The average across the United States is only 33%. This means that in California, renting is a lot more common than in many other places.

There are a few reasons why so many people in California rent their homes. First, the cost of buying a house in California is very high, which makes it tough for many people to afford to buy a home. Also, California has a lot of good jobs and opportunities, which attracts people from all over. However, because so many people want to live and work there, the competition for housing is intense, and this drives up rental prices too. So, renting becomes the best or only option for many who move to California looking for work or who simply can't afford to buy a home yet.

The Curious Case of Rent-Free Tenants

Interestingly, a small percentage of Californian tenants, specifically 1.4%, live in rent-free conditions. This is slightly less than the national average, which stands at 1.6%. This unique living situation invites us to delve deeper into the types of arrangements and the social dynamics that make rent-free living possible.

Several factors contribute to these rent-free scenarios. One common arrangement is when individuals live with family members who own the property and do not charge them rent. This could include young adults living with parents, extended family helping each other out, or elderly parents moving in with their adult children.

Another scenario involves living arrangements with generous landlords. These landlords might offer rent-free living as part of a barter system, where tenants provide services like property maintenance, caretaking, or other work in exchange for living space. In some cases, landlords might provide free housing to individuals as a form of charity or support, especially if the tenants are in difficult financial situations or are close friends or family members.

The True Cost of Mortgage-Free Living

Living without a mortgage in California doesn't mean homeowners are free from ongoing expenses. These homeowners face median monthly expenses of $834, considerably higher than the national median of $629. This difference underscores the additional financial burdens that California homeowners must manage, even after paying off their mortgages.

One significant component of these costs is property taxes. California is known for its high property values, which, while beneficial in terms of asset value, also lead to higher property taxes. These taxes are calculated based on the assessed value of the home, and in California, this can mean substantial annual expenses for homeowners.

Insurance premiums also play a major role in the monthly costs for California homeowners. Given California’s susceptibility to natural disasters such as wildfires, earthquakes, and floods, insurance costs can be high as they need to cover a wider range of potential damages compared to other states. Homeowners must often purchase additional policies for adequate protection, which increases their insurance expenses.

Maintenance expenses also contribute to the financial load. The cost of maintaining a home in California can be higher than in other states due to the higher costs of services and materials. Regular maintenance is crucial to preserving the home's value and ensuring it remains a safe and pleasant place to live, but this also comes with a recurring cost.

Together, these factors—property taxes, insurance premiums, and maintenance costs—combine to create a significant ongoing financial commitment for California homeowners, illustrating that the absence of a mortgage does not equate to the absence of housing-related expenditures. These expenses require careful financial planning and management, particularly in a state where the cost of living is already high.

Achieving a mortgage-free status in California is more an exception than a norm, influenced by high real estate prices and a competitive housing market. For many Californians, remaining in a mortgage is not only a necessity but a strategic choice to manage other living expenses in a state known for its high cost of living. My goal with this article was to shed light on the challenges and invite a broader conversation on potential solutions to improve housing affordability and economic stability in California.

Love,

Kartik

Can I Get a California Real Estate License If I Live in Another State?

Real Estate Lead Generation: Master Networking & Referrals

The Ultimate Guide to Creating a Home Buying Checklist

Founder, Adhi Schools

Kartik Subramaniam is the Founder and CEO of ADHI Real Estate Schools, a leader in real estate education throughout California. Holding a degree from Cal Poly University, Subramaniam brings a wealth of experience in real estate sales, property management, and investment transactions. He is the author of nine books on real estate and countless real estate articles. With a track record of successfully completing hundreds of real estate transactions, he has equipped countless professionals to thrive in the industry.